Solid Gold Coast economy boosting retail sector: Colliers International

The Gold Coast tourism market continues to drive economic growth and support demand for retail activity, according to a new market report.

Approximately 25% of investment sales in Queensland in 2018 were Gold Coast retail assets, said the Colliers International release.

And $465 million in sales were recorded in the Gold Coast retail market in 2018, with yield spreads up to 100bp compared to Sydney and Melbourne.

Steven King, Director-in-Charge of Colliers International Gold Coast said international tourism and education sector may receive a boost at the back of the lower Australian dollar, which will ultimately support demand for retail property and increase demand for hotel accommodation.

“We have seen $500 million worth of investment in new retail developments in 2018, such as the $470 million Westfield Coomera, which is a testament to owners’ optimistic outlook for the retail sector in the Gold Coast over the short to medium term,” said King.

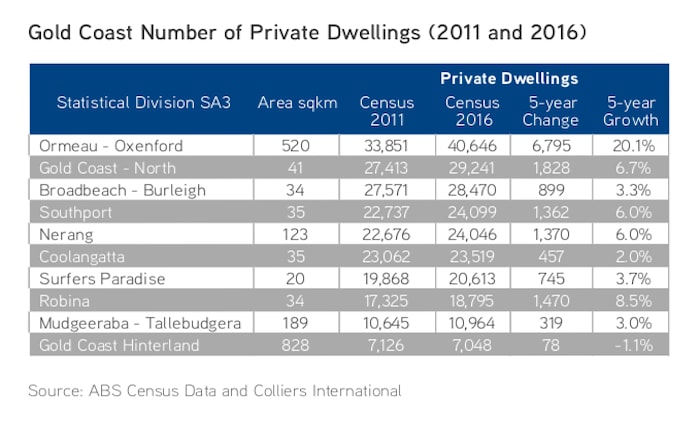

“Low regional unemployment, population growth and consistent net interstate migration is supporting the retail activity and demand for future retail centres. Residential hot spots like Ormeau, Oxford and Nerang are desired locations for future retail development.

“Consistent growth in airport operations is on the back of increasing tourism activity which is boosting the retail sector. Per the Gold Coast Airport Master Plan 2017, the Gold Coast Airport will service 16.6 million passengers by 2037, an average growth rate of five% per annum.”

The author of the report, Research Manager at Colliers International Karina Salas, said residential sector is set to benefit from strong forecast population growth and solid infrastructure investment pipeline.

Click here to enlarge:

“Median house price on the Gold Coast is $100,000 more affordable than Noosa, and $50,000 more affordable than Brisbane,” said Salas.

“The affordability factor along with the unique lifestyle makes Gold Coast an attractive location for owner-occupiers and investors.”

Click here to enlarge

“Looking at other markets, value proposition of investment in the Gold Coast office market is solid, considering the current prime-yield spread of 200bp compared to the Brisbane market,” said Salas.

“The performance of the leasing market is also gradually strengthening, as demand for office accommodation continues to gradually increase and support a consistent tightening of vacancy rates.

“When it comes to the industrial sector, Yatala precinct will remain a popular location for industrial operators looking for large space requirements of 2,000 square metres and above. This is because Yatala offers affordable leasing and investment opportunities compared to other industrial precincts in Brisbane.

“The net face rents in Yatala are usually 15 to 20% cheaper than Brisbane industrial precincts, while land values could be up to 35% more affordable compared to other industrial precincts in Brisbane.

“Demand in this precinct is coming from the growing transport and logistics sectors, considering the excellent accessibility which is further supported by $2.5 billion M1 upgrade masterplan within the Logan corridor and Yatala.”

Click here to enlarge