Retail purchasing facing omni-channel revolution: CBRE

GUEST OBSERVATION

Australians once lax expectations concerning retail delivery times are changing and service providers must adjust, a new survey suggests.

The retail goal posts are shifting, and as a result, businesses need to transform entirely.

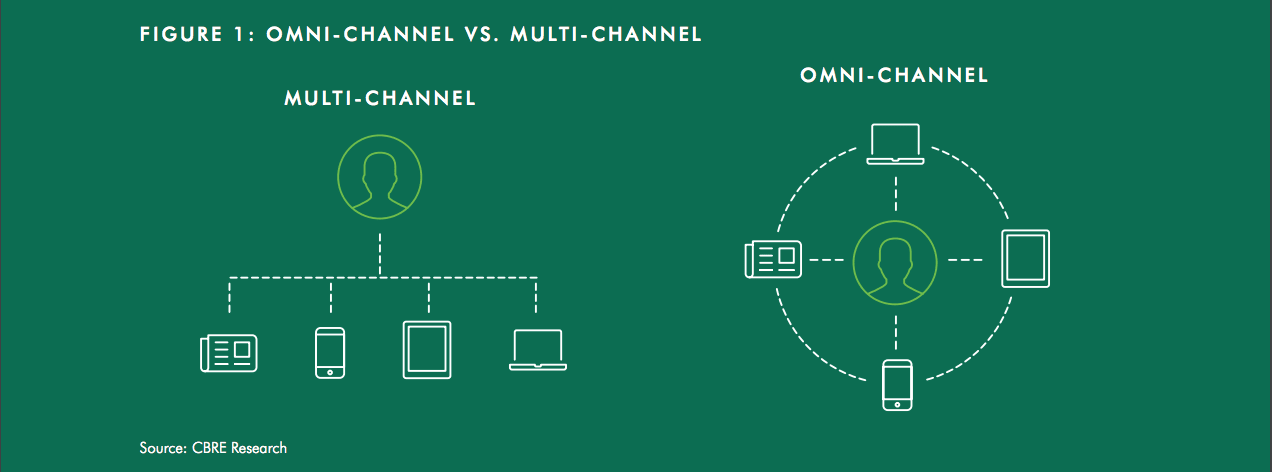

CBRE has released a research report about the "Omni-Channel Revolution" the rise of and the importance of melding of shopping, advertising, delivery and payment into one unified buying experience in an increasingly online world.

A shopper’s journey now spans across bricks and mortar stores, social media, apps, desktops and other mobile devices. Constant digital connectivity is a driving force behind evolving customer experience and fulfilment expectations and over 80% of all Australians own a smart phone the newest tool for online shopping.

Online spending in Australia currently accounts for approximately 9% of all retail trade, with this expected to rise to 12% by 2022 accounting for roughly AU$24.4 billion to AU$43.1 billion.

It is estimated that by 2020, a third of in-store retail sales will be in some way influenced by the web. This growth in e-commerce sales will generate demand for an additional 350,000 square metres of distribution space annually.

In CBRE’s Asia Pacific Millennial Survey, online shopping was selected as the most frequent method of purchasing goods, with respondents shopping online an average 4.9 days in Australia. However, millennials frequent bricks and mortar stores more than other generations preferring to make a final transaction in-store. This demonstrates the necessity of an omni-channel strategy to attract shoppers.

Retailers benefit from incorporating omni-channel operations into their business with successful omni-channel operations shown to improve loyalty, and repeat visitation to the retailer’s stores increasing up to 23% after strong omni-channel engagement.

Omni-channel engagement provides tailored analytics and by analysing customer data, retailers can more easily target a specific market through the most successful channel.

Greater choice in products and services is also dictating where individuals spend money, as a result shoppers are not as brand-loyal as they used to be so positive experiences for customers are vital for repeat sales and the ability to offer personalised services will prove crucial for both attracting business and building customer loyalty.

A McKinsey study showed that 25% of consumers were willing to pay extra for same day or instant delivery and this is expected to increase in coming years as just over 30% of millennial customers are more likely to choose same-day and instant delivery.

However reverse supply chain operations are equally important, with growing costs on both retailers and the environment as the volume of returns results in roughly two billion kilograms of goods being sent straight to landfill each year in the US alone because the cost of processing the return exceeds the cost of disposing of it.

Strong returns policies create customer loyalty and if a returns process is not easy, cheap and efficient, shoppers are not likely to use that retailer again, whereas if it is, 92% of consumers would consider making another purchase through that retailer.

It is estimated that approximately 30% of all goods sold online are returned, and 30% of these returned products never find their way on to a secondary consumer, when observing returns of clothing and apparel is 40%, which in 2017 means $2.32 billion of goods were sent back to retailers costing them 10-20% of their profits.

Research found that 19% of the Top 250 retailers profitably fulfil omni-channel demand and that 28%. Total transportation cost is in the last kilometre meaning there is a growing competition for companies to secure warehousing and short term storage closer and closer to domestic centres. Particularly as Australian cities are built around ports meaning that industrial sites in these areas will be hotly contested as significant amounts of new logistics space will be required.

Omni-channel retail and logistics in Australia is still evolving, and the cost of implementing last-kilometre delivery solutions for retailers, combined with Australia’s low population density, means same-day delivery and fulfilment is still a work in progress with the average delivery time in Australia being 3-10 business days, however despite this the convergence of retail and logistics is well underway.