Outer-Sydney land market in recovery phase of cycle: BIS Shrapnel's Martin Bregozzo

The outer-Sydney land market has moved into an early recovery phase of the property cycle – let’s say seven on the property clock – and Macquarie Street’s focus has shifted to supply side incentives, corralling purchasers toward new dwellings. The state’s growth engine lies in a healthy and vibrant land market; the critical ingredients of which are: measured supply meeting strong demand with rising prices, availability of credit, and market certainty.

For the better part of 2003-04 through 2008-09, Sydney’s developers have been “on strike” — their field thinned out as the business of being a developer became all too hard; with post-GFC funding constraints, diminished margins, uncertainty and delays in the approval process, increasing holding costs and the weight of government charges, levies, fees and taxes. The following chart illustrates the cost contribution to lot production: land acquisition 34% land preparation 11%, developer profit averaging 18% and government taxes some 26%.

Click to enlargeThe GFC had the real potential of being outer-Sydney land market’s coup de grâce – as lot production fell to only 1,400 lots – but for rapid intervention by both state and federal governments in the form of housing grants/incentives.

Broadhectare lot production increased for both 2009-10 (some 2,960 lots) and 2010-11 (at 4,200 lots), with NSW Department of Planning and Infrastructure reporting 4,230 lots released for 2011-12.

A slow correction to land prices from 2007-08 has underpinned future market growth; the outer-Sydney median land price peaked in 2004-05 before falling some 29.5% in real terms over the four years to 2008-09.

Since this time, growth has averaged 2.8% per annum with a 2011-12 median of $301,900. For development to occur, the market requires appreciating land prices. The recent growth in established outer-Sydney house prices will encourage more upgraders to sell and take up house-and-land packages over an established dwelling.

Demand is now sufficiently strong enough to drive price growth and maintain this momentum. Generally, land price growth is sharper during a residential upturn and remains flatter through a market downturn. Given the timing lags from planning through development to sale, developers are often caught short during an upturn, driving strong price growth. An over-supply then emerges, resulting in a period of price stagnation.

Overall, however, average price growth for land slightly outpaces that of houses. When house prices are outpacing construction costs, the residual flows back through to the residual value of the land – a clear link between demand pull inflation and asset pricing.

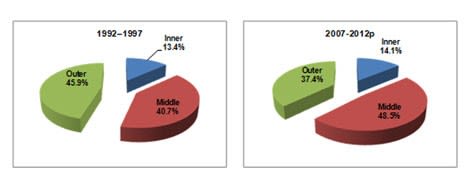

Click to enlargeWhen comparing the two periods 1992-97 and 2007-12 a trend away from the outwards expansion of the populace is evident, with the proportion of new dwelling approvals in the inner and middle rings increasing from 54% to 63%.

This is significant for the outer-Sydney land market as infill development tips the scales in favour of areas located closer to Sydney’s urban and commercial core; consumers adjusting their preference for “backyard, barbecue and big commute” to “balcony, park and lifestyle”.

The enhancement of satellite employment centres (such as Parramatta, Liverpool, and Campbelltown) would encourage the local income growth needed to service mortgages, broaden the economic base of these areas and in turn support the land market. Opportunity driving growth and growth driving opportunity.

Share of total dwelling approvals by inner, middle and outer Sydney

Click to enlargeSource: ABS, NSW Department of Planning and Infrastructure, BIS Shrapnel

Not surprisingly, first-home buyers purchasing house-and-land packages are typically most active in the outer ring areas as opposed to the inner and middle-ring areas; the lower land costs meet their income and equity levels.

The first-home owner segment typically represents around 20% of total market activity; importantly, however, the first-home buyer activity provides a base load of activity facilitating the upgrader, changeover and investor market segments.

At current land prices, new houses are relatively unaffordable for first-home buyers, and a buoyant outer-suburban housing market is required for upgraders to sell their dwellings into. The north-west region has the greatest level of new lot production with some 37% of total lots produced over the 2000–2012 period and generally holding up better than the south-west (27%) and central coast (16%).

Hemmed in by the Blue Mountains to the west and the city to the east, Sydney faces a shortage of viable sites to the southern and north-western growth corridors, areas with disparate and fractured ownership patterns (mostly hobby farms and market gardens).

A program of strategic site consolidation, combined with an accelerated infrastructure delivery program, is needed to open up these areas to house the needs of Sydney’s future populations. But the good news story is that a corner has been turned, although lot production is still well away from, and possibly unlikely to ever get to, the 9,000 lots produced annually at the turn of the last decade.

Martin Bregozzo is a senior project manager and property economist at BIS Shrapnel.