Investors squashed

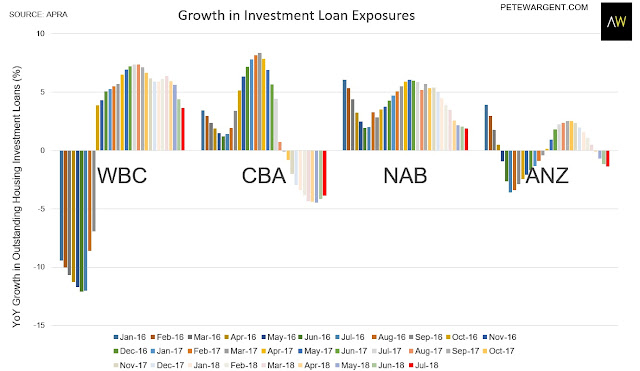

APRA's latest monthly banking statistics reported negative growth in investment loan exposures in July.

Commonwealth Bank, ANZ Bank, Westpac Banking Corp, and Suncorp all recorded an outright decline in outstanding housing investment loans, while NAB's investment loan book was broadly flat.

Year-on-year growth is either negative or slowing for each of the major banks.

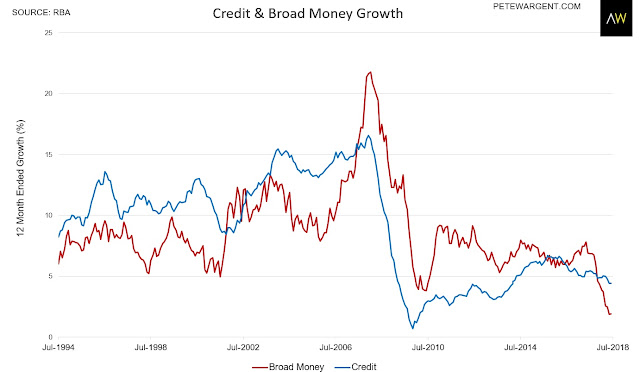

The Reserve Bank of Australia (RBA) also reported that year-on-year investor credit growth hit its lowest level on record in July 2018.

With annual personal credit growth contracting even further to -1.4 per cent and business credit growth slower than a year earlier at just 3.4 per cent, the growth in total credit is now at the lowest level since the first quarter of 2014.

Lending to homebuyers remains solid, but broad money growth is tracking at quarter-century lows.

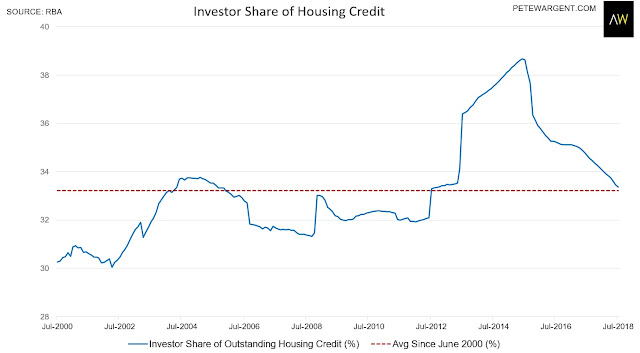

The housing investor market share fell further to 33.2 per cent, now having fallen back in line with the average level for this millennium to date (there have evidently been a few misclassifications along the way).

Equal & opposite reaction

Housing markets can be a finely balanced affair, with the strong level of rental supply of recent years now set to reverse.

Given that we've been through a period of strong immigration/population growth alongside falling home ownership rates, from a macro perspective presumably this must be leading to rental shortages in some parts of the country (not so much in the big capital cities yet, due to the high level of off the plan apartment purchases through this cycle and the related lag effect).

I don't have much time to look at it today, but a quick glance at the stats shows rental vacancy rates plunging towards zero in Orange, from certain parts of Adelaide to Ballarat and Canberra, and from Geelong West to Hobart and Moranbah.

If the investor squeeze persists Melbourne may be next of the largest metropolises.

If the investor squeeze persists Melbourne may be next of the largest metropolises.

Still plenty of apartment supply to be absorbed in the big cities, but this will be one trend to watch with interest.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.