Hotels become Australia’s highest returning real estate asset class: Savills

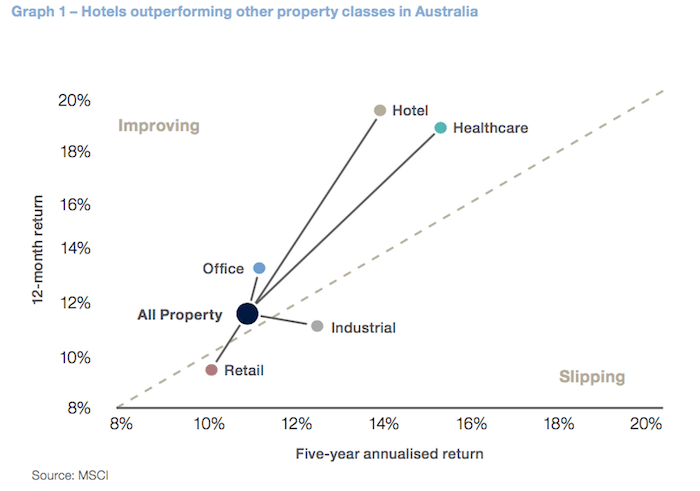

Hotels are hot property for investors at the moment, outperforming all other property classes in Australia, says a recent report by Savills.

With international and domestic visitors growing 11.5 percent and 5 percent respectively in CY 2016, the hotel industry has not seen growth at this level since the Sydney 2000 Olympics, according to Savills Australia’s Hotels market report.

Sydney and Melbourne are the standout performers, with their strong market KPI’s against a backdrop of compressing yields.

Chinese tourists take the lead in international visitors, growing at 22 percent, helped by more flights between the two countries and a relatively low Australian dollar making the country a more affordable destination, says Michael Simpson, Savills managing director of Hotels.

“In a very positive sign for the depth of the market, the outstanding international inbound growth has been experienced across a wide range of markets, with inbound visitor growth from many established Asian markets, as well as the US, above 15 percent,” said Simpson.

In further proof of the strength of the market, Tourism Research Australia’s 10-year forecast expects international visitor nights and domestic visitor nights to grow at 5.6 percent and 3.1 percent annually respectively. Australia can expect to see increased room night demand nationally for the foreseeable future.

The Australia-wide market achieved a ‘revenue per available room’ (RevPAR) for CY 2016 of $139, which represented YOY growth of 2.2 percent.

All Australian cities posted RevPAR growth except Perth, Brisbane and Darwin with RevPAR declining in those cities by 9.3 percent, 8.7 percent and 9.6 percent respectively. The decline in performance of these markets is primarily due to the impact of the end of Australia’s resource boom, and rise in room supply.

For the remaining markets, Savills says growth in market KPI’s can be attributed to an increase in leisure demand from domestic and international markets, stimulated by a lower Australian dollar and stronger economic activity underpinned by construction and infrastructure projects.

China is the engine room for visitor night growth in Australia right now, says Simpson.

Australia received more than 7.4 million international visitors (up 11.5 percent) and 251 million international visitor nights (up 3.8 percent) for the year ended September 30, 2016.

Tourism Research Australia recently released international visitor numbers for CY 2016 which totalled 8.3 million, representing a healthy year-on-year (YOY) growth of 11 percent.

The New Zealand market continues to contribute the highest number of visitors to Australia. However, the China visitor market recorded YOY growth of 21.9 percent, enabling it to exceed 1 million visitors, who more importantly spend an average of 40 nights in Australia when touring Down Under.

As a result, China produced 43 million room nights representing almost three times the volume produced by New Zealand. The Chinese visitors also tend to spend more per capita compared to other visitors.

Simpson went on to say that Sydney’s strong performance is set to continue with occupancies reaching capacity during peak holiday and corporate activity periods, providing the opportunity for hoteliers to grow ADR.

“Sydney’s Luxury segment capitalised on the strength of the market achieving an occupancy of 85.9%, and ADR of $339 (up 7 percent), delivering a RevPAR of $291 (up 5.7 percent), which exceeded Melbourne’s Luxury segment RevPAR of $271.

“The key factors underpinning Sydney’s current and expected future performance are a combination of buoyant economic metrics, strength in banking, finance, insurance, professional services and construction/ infrastructure projects, which are collectively fuelling a tsunami of economic activity and room night demand in Sydney.

“For the next 10 years, Sydney occupancy will remain in the 80th percentile,” said Simpson.

Melbourne was the second highest performing market in CY 2016 with an increase in occupancy for the fourth consecutive year. Conversely, Average Daily Rate (ADR) declined marginally, suggesting that while occupancy remained strong, hoteliers were unable to grow rate during non-peak periods. As a result RevPAR remained relatively stable in CY 2016, when compared to CY 2015.

Simpson said the inability to significantly grow ADR in CY 2016 is also demonstrated by Melbourne’s Luxury segment which reflected steady YOY market KPI’s, achieving an occupancy of 89.5 percent, ADR of $302 and delivering a static RevPAR of $271.

“Melbourne’s construction boom of residential apartments, commercial space and continuing development of Docklands, has also encompassed new hotel development,” he said.

“Despite the strength and enduring nature of Melbourne’s events calendar and symbiotic corporate activity Melbourne enjoys with Sydney, we anticipate that Melbourne market KPI’s will be under pressure to match Sydney’s performance in coming years given the relative challenge of delivering new supply in Sydney.”