Flexible workspaces on the rise in Brisbane: Colliers

There has been a significant growth of flexible workspace across Brisbane over the recent years, according to new research from Colliers International.

Flexible Workspace, put simply, is a workspace which enables occupiers the ability to utilise space on demand, according to Brisbane Flexible Workspace: Market Trends and Outlook.

Flexibility is derived from both the physical environment and financial commitment. Physical environments are adaptable spaces which can include co-working hubs and serviced offices, business lounges, event areas, elastic space for project teams, churn space for relocations, network offices for sales teams, and dedicated areas within agile working environments.

Occupiers view these spaces as either core space or supplementary space, dependant on their own situation. Financial flexibility is derived from the ability to commit to short, medium or long-term agreements, with the capacity to adjust footprint and utilisation as required, and in some instances transfer financial liability from redundant locations to essential locations.

Ultimately flexible workspace is about meeting the ever-changing needs of occupiers, maximising efficiency and productivity, minimising overheads and cost, and enabling individuals and organisations to do their best work.

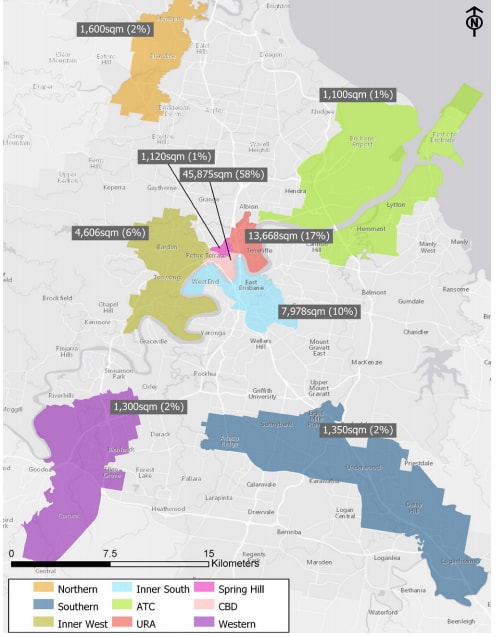

The total stock of flexible office space across Brisbane as at May 2017 was 78,597 sqm. Based upon this figure Flexible Workspace across greater Brisbane represents 2.34 per cent of the total office market.

In comparison a similar figure has also been identified for Sydney representing 2 per cent of the market. A factor contributing to this may be the fact that Brisbane currently has a higher vacancy rate on offer compared to Sydney CBD. Consequently, companies like Regus and Corporate House are locking in space today (with the market favouring tenants) rather than the latter, to offset their running/setup costs with high incentives, lower rents, and generally favourable terms that are currently on offer.

Seemingly the recent surge in Flexible Workspace operators committing to head leases in the market is based on their expectation of significant growth in demand.

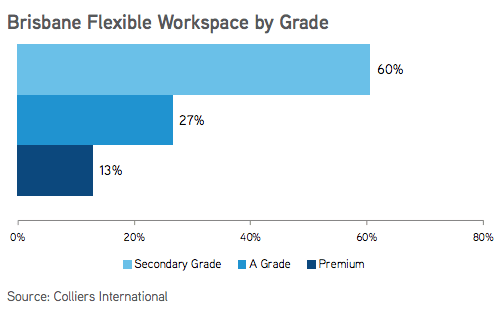

According to the report, 58 per cent of the total Flexible Workspace was located in Brisbane CBD, 17 per cent in the Urban Renewal Area, 10 per cent in the Inner South and six per cent in the Inner West with the remainder of space scattered across greater Brisbane. Of the total space offered 13 per cent is Premium, 27 per cent A Grade and 60 per cent Secondary Grade. The maximum space in operation was 14,200 sqm (serviced) and minimum 100 sqm (co-working).

Serviced, Incubator and Co-Working Office Space – Greater Brisbane

The best way for your business to determine if you need flexible workspace is to consider what your people need and where they need to be to efficiently complete their work and get their day-to-day tasks done, according to report author Helen Swanson of Colliers research.

“How we work and what our office should look like is an ever-changing topic and only by assessing your business needs will you know what workspace is best suited to you – there is no one-size fits all solution,” says the report.

“Finally, we are also seeing traditional serviced offices starting to remodel their spaces to accommodate a more modern look, often with similar design and greater lounge areas,” it adds.

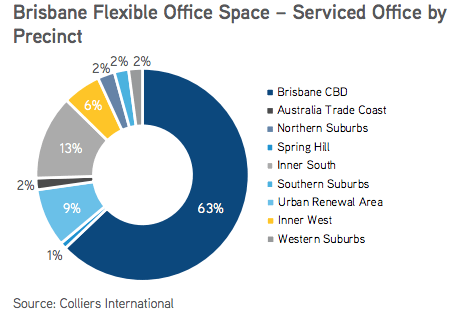

There is currently 62,137sqm of serviced office space on offer across greater Brisbane. Of this 63 per cent is located in Brisbane’s CBD, 13 per cent in Brisbane’s Southern Suburbs, 9 per cent in the urban renewal area and six percent in Brisbane’s Inner West.

The remainder of serviced office space was located across the rest of greater Brisbane. The maximum space operating as serviced office is 14,200 sqm located in Brisbane CBD whilst the minimum amount is 500 sqm. 16 per cent of serviced office space was premium, 27 percent was A Grade and a further 57 percent was secondary grade.