CPI forecast to rise for June quarter: Westpac's Justin Smirk

EXPERT OBSERVER

Westpac is forecasting a 0.5% rise in the June quarter consumer price index (CPI) lifting the annual pace to a 1.5% rise from a 1.3% rise.

The June quarter tends to be a seasonally soft quarter with the ABS projecting a seasonal factor of 0.2ppt increase. The seasonally adjusted CPI is forecast to rise 0.7%.

The trimmed mean is forecast to rise 0.33% in the June quarter or 1.5% over the year and the weighted median is forecast to rise 0.30% in the June quarter/1.1% over the year.

The average of the core inflation measures is forecast to print 0.31% in the June quarter with the annual pace easing back to a 1.3% rise from a 1.4% rise.

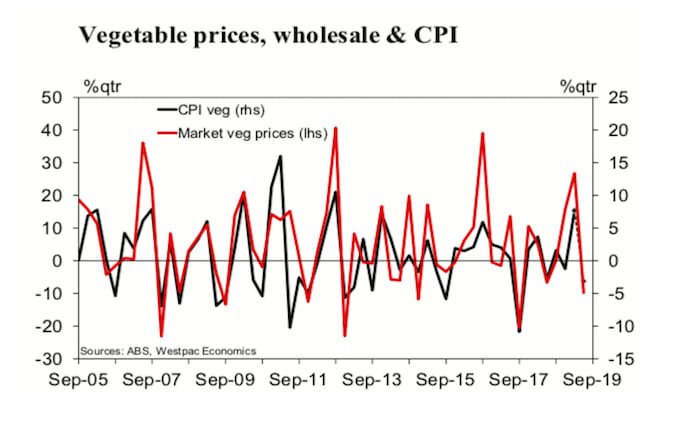

In June, we forecast that fresh fruit and vegetable prices drag food prices down 0.4% in the quarter.

Click here to enlarge:

Source: Westpac

Housing costs are down slightly due to falling utilities and there is the usual seasonal fall in pharmaceuticals while car prices fall again.

Auto fuel is forecast to make the single largest contribution rising 11%.

Alcohol and tobacco rose modestly while clothing and footwear had a positive quarter.

Health costs continue to rise solidly (as rising medical and hospital services more than offset falling pharmaceuticals) and there was an unseasonal gain in domestic holiday travel.

Traded prices are forecast to rise 0.8% in the June quarter while non- traded prices are forecast to rise 0.4% in the June quarter.

Outside of fuel, there is very little inflationary pressure in the Australian economy.

Click here to enlarge:

Core inflation remains well below the bottom of the RBA target band as moderating housing costs hold back modest inflationary pressure elsewhere.

Competitive deflationary pressure in consumer goods is limiting the pass through of the weaker AUD though it is having an impact.

As such, we find it hard to see how core inflation could break higher any time soon.

Click here to enlarge:

Recap March quarter CPI - above expectations

The CPI was flat in the March quarter compared to a market median expectation of 0.2% and Westpac’s 0.1%.

The annual rate eased back to 1.3% from 1.8% in Q4.

Of note, housing costs were flat in the quarter as falling dwelling prices offset modest gains in rents and other housing costs which is key to low non-tradable and core inflation prints.

Click here to enlarge:

Click here to enlarge:

Click here to enlarge:

Drought is a surprising negative for food prices in Q2

The continuing dry conditions on the east coast have, for now, suppressed wholesale prices for agricultural goods as growers sell stock they can no longer support increasing supply.

This is particularly so for meat (beef and lamb) but we have to be careful not to take this too far due to significant variation in the quality of stressed stock plus, for now, anecdotally many growers are choosing to bear the costs of feeding stock rather than selling.

Click here to enlarge:

Click here to enlarge:

Beef and veal prices are expected to rise modestly as are lamb and goat prices.

Pork should have a seasonal fall in price but we are closely watching the rise in global pork prices as a large proportion of the Chinese pork herd is slaughtered to control an outbreak of African swine flu. This should be boosting the price of imported pork and has been boosting the demand for alternative meats including chicken.

Click here to enlarge:

Wholesale prices are pointing to meaningful fall in fresh fruit and vegetable prices. All up we are looking for a –0.4% fall in food prices (–0.07ppt contribution).

Alcohol and tobacco remains a source of inflation

Tobacco in particular remains a key source of inflationary pressure.

Even without excise indexing, tobacco prices are expected to rise 2% in Q2 contributing 0.06ppt to the CPI.

By comparison alcohol is expected to rise 0.4% contributing 0.02ppt to the CPI.

Clothing and footwear has a small seasonal rise

In recent years clothing and footwear prices have tended to rise in the June quarter due to the repricing post the New Year sales and before the start of the end of financial year sales.

We also expect to see some pass-through from the weaker AUD that has given a small boost to imported goods prices.

However, the trend has been for the Q2 rise to be softer than historically hence Westpac is forecasting a very modest 0.5% gain in the quarter contributing 0.02ppt.

Housing set to be flat in the quarter

We are looking for rents to be flat in Q2. Industry data suggests that with vacancy rates rising, particularly in Sydney, the pressure remains on rents.

But this series measures all rents being paid, including public sector rents, and not just the new contracts being signed (which is what is reported in most industry data).

As such, we caution against forecasting ongoing falls in rental prices, at least for now.

Dwelling purchase price changes in Sydney and Melbourne have been quite volatile on a quarterly basis but there has been a moderation in the annual pace consistent with industry data.

Price changes have eased in Brisbane and Adelaide while the correction in Perth was having a second wind through the second half of 2018 but stabilised in 2019 Q1.

For utilities we are also looking for the usual June quarter rebound in gas prices while the wholesale prices suggest some further correction in electricity prices is likely.

Our forecast a 0.1% fall in housing costs will contribute –0.01ppt to the CPI.

Household contents and services to have a seasonal bump

Furniture and carpets, household textiles and appliances are set to have a seasonal bump but we have muted it a bit for appliances as the price competition here has been limiting this rise.

Our estimate is 0.5% (contributing 0.04ppts) does include an allowance for some modest pass through from the impact of the weaker AUD on import goods prices.

Health has a seasonal bump despite falling pharmaceuticals

The June quarter is the first quarter for many households where the PBS (Pharmaceutical Benefits Scheme) kicks in as they have spent over the threshold limit on healthcare and thus can access government assistance.

But the rise in other health costs more than offsets this price fall and Westpac is forecasting 2.1% rise in health costs contributing 0.12ppt.

Automotive fuels will be the main boost to prices

For transport, pump prices of automotive fuels lifted 11% in the June quarter.

However, allowing for a seasonal fall in vehicle prices, and modest gains elsewhere, transport costs are likely to rise 2.9% in the June quarter contributing 0.29ppt.

Click here to enlarge:

Airfare data suggests domestic holiday travel prices are rising rather than the seasonal norm for a fall.

Normally domestic holiday travel costs fall in the June quarter as it is the offseason for the Australian travel/holiday industry. But BITRE airfare data suggests there were some modest gains in the quarter.

In addition, the weaker AUD is pointing to some price gains for international holidays.

When you add in the ongoing falls in the price of audio visual and computer equipment, recreation and culture is forecast to rise 0.7% in the June quarter contributing 0.07ppt.

Click here to enlarge:

Core inflation remains below the bottom of the band.

The trimmed mean is forecast to rise 0.3% with the annual pace easing back to 1.5% from 1.6% over the year.

Our forecast for the average of the RBA core measures of inflation is a modest 0.3% in the June quarter with the annual rate easing back to 1.3% from 1.4% over the year.

This will see the two quarter annualised pace of the average of the core measures ease back to 1.0% from 1.2% over the year.

Traded goods and services are forecast to rise 0.8% in the June quarter/0.7% over the year and non–traded prices are forecast to rise 0.4% in the June quarter /1.9% over the year.

Click here to enlarge:

JUSTIN SMIRK is a senior economist, Westpac Group and can be contacted here.