Commercial investment could exceed $30 billion in 2017: Cushman & Wakefield

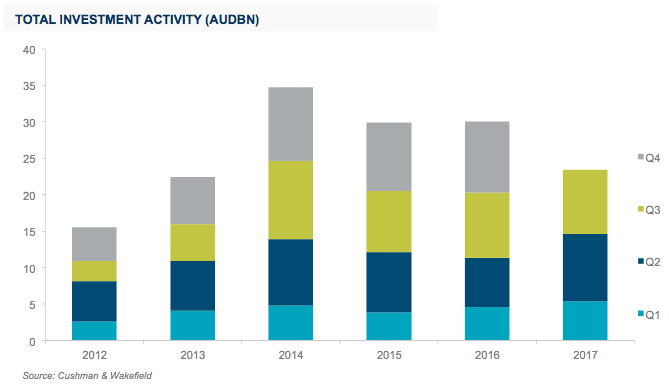

Commercial investment activity in Australia in the third quarter remained strong with $8.8 billion invested over the quarter, amounting to a total investment of 23.3 billion so far this year, according to Cushman & Wakefield.

This follows an exceptionally strong second quarter in which $9.2 billion was invested involving a flurry of large deals late in the quarter, according to the commercial real estate company’s latest research.

The number of deals and average deal size remain broadly flat quarter on quarter at 186 deals at an average of $47 million.

The total investment volume of $23.3 billion has increased from the $20.3 billion recorded at the same point last year.

“With 10 assets at an estimated value of almost $2.4 billion on the market in Sydney CBD alone, the fourth quarter of 2017 looks likely to continues in the same vein as the start of the year,” it said.

Annual investment volume is expected to exceed $30 billion for the fourth consecutive year and could go close to the peak of $35 billion recorded in 2014.

Unlisted funds continued their run of strong buying activity, ending the quarter at $1.5 billion in net purchasing.

In contrast, REITs retuned to net selling at $120 million in the red.

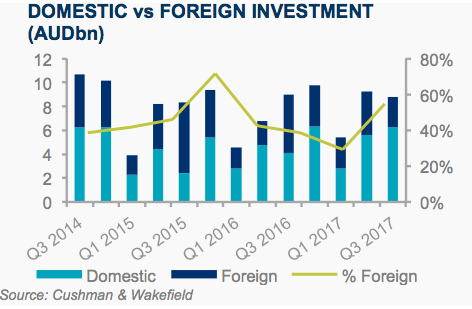

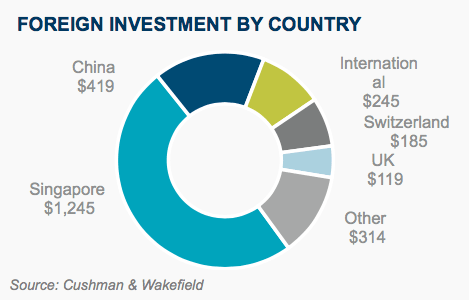

Foreign investment slowed quarter on quarter to $2.5 billion, representing 29% of total investment.

So far this year, foreign investors have committed $8.7 billion (37%).