Wages tick along

More wages weakness reported in the December 2018 quarter, though I doubt it'll be enough to move the needle for the Reserve Bank's view too much.

Wages growth was +0.6 per cent for the private sector, and +0.6 per cent for the public sector, seasonally adjusted, decimal point quibbles aside.

Annual growth in private sector wages of +2.29 per cent was still plenty slower than in the public sector at +2.53 per cent.

However, this was the 'fastest' annual pace of growth in private sector - if you can justifiably use the word fast in this context - in the four years since December 2014.

And it's also well ahead of headline inflation, which could feasibly sink to just 1½ per cent next quarter on lower fuel prices.

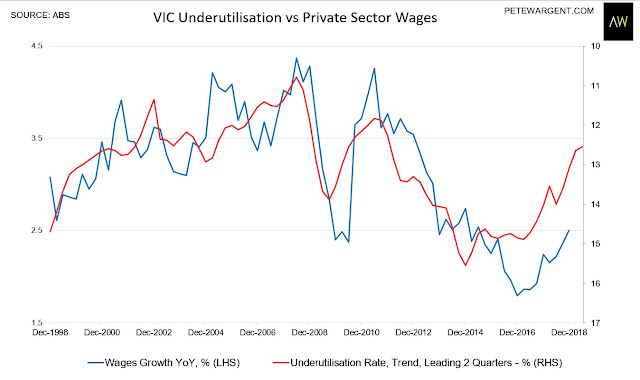

As noted here previously (h/t Justin Smirk, Westpac) Victoria has been creating a thunderous volume of job openings and is nipping along nicely towards full employment, so wages will almost certainly pick up here.

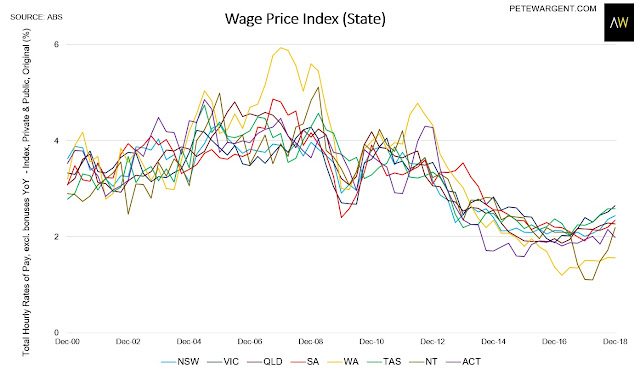

Indeed, at the state level for all sectors Victoria (+2.7 per cent) and New South Wales (+2.4 per cent) have accounted for most of the improvement since the nadir, while sprightly Tasmania (+2.6 per cent) is resurgent from a low base.

Not much joy here in Western Australia, though we should acknowledge that WA has seen by some margin the greatest increase in wages over the past two decades, so a bit of post-boom payback was perhaps due.

At the industry level the strongest wages growth was seen in healthcare and social assistance (+2.8 per cent), and electricity, gas, water, and waste (+2.8 per cent), while the weakest growth was in IT & Telcos (+1.6 per cent).

The wrap

Still pretty sluggish overall, but skilled job vacancies came in at a near 7-year high today, so there's still probably just enough evidence that the jobs market might pull through, provided credit flows a bit more freely in 2019.