How to invest in property in a city you’ve never been to

For the majority of property investors, it is very difficult to accept the concept of buying investment property in another city or state. In fact, recent studies show that only 11% of investors are investing in property interstate. As much as we all want to be logical and rational in our investment decisions, for many of us, emotion does come into play and the comfort that comes with knowing an area well does impact where and what we invest in. This can have significant effects on your return on investment.

At some point, as an investor you will be challenged by something that encourages you to look at another city. Perhaps it is affordability, or the need to diversify your portfolio – but when this challenge presents itself, if you are able to recognise the benefits of Looking beyond your home city, the next steps will be easier than you initially thought, and you will be able to move forward with your investment decisions and continue to build your portfolio.

THE BENEFITS OF INVESTING IN MULTIPLE CITIES

Market conditions and cycles continually fluctuate between each state and city, so that when values are rising in one market, another area may be flat while another may be poised for growth. For many investors, diversifying across multiple cities enables them to take advantage of the different market cycles.

Investing in another city or state also offers a wider variety of choice in affordable investment options. For many who are increasingly being priced out of Sydney, the relative affordability of the other major capital cities has strong appeal.

There are also differences in capital growth and rental yields at varying times across the different cities. For example, according to figures from CoreLogic, in the last year to 30 June 2017, Melbourne houses had the highest capital growth (15%) of all the capital cities and all housing types. On the other hand, Brisbane apartments had the highest rental yield (5.2%) out of the 5 major Australian capital cities. By diversifying your portfolio across multiple cities, you will have a better opportunity of targeting your desired capital growth and rental yield across your portfolio.

Another important consideration is the varying taxes across the different states. Each state has its own stamp duty rates and differing land tax thresholds – as well as continually changing Government incentives and grants. By diversifying across the states, investors can take advantage of the different thresholds and incentives on offer.

SO, WHERE AND HOW TO BEGIN?

Once you’ve decided to invest in another city, the next steps are similar to the process you would go through in buying residential property in your own city or state, with a few key factors to consider. Here’s our top 5 property investment tips for investing in another city or interstate.

Research

Read as much as possible. For most people, it’s an impossible task to go and personally visit every city you may plan to invest in – both in terms of time, and money spent – and without any potential payback. Instead, consider reading up online; there are many wonderful resources and reports to equip you with knowledge of the different cities and how the markets are performing.

Talk to experts with local knowledge

Get an understanding of how locals live – do they want to be close to the beach, or close to cafes? Do locals catch the train or bus or tram to work? Gain insights into what locals want from a property – keeping in mind this may vary significantly to what you might want from a property, or what people in your city may want from a property.

Know your budget

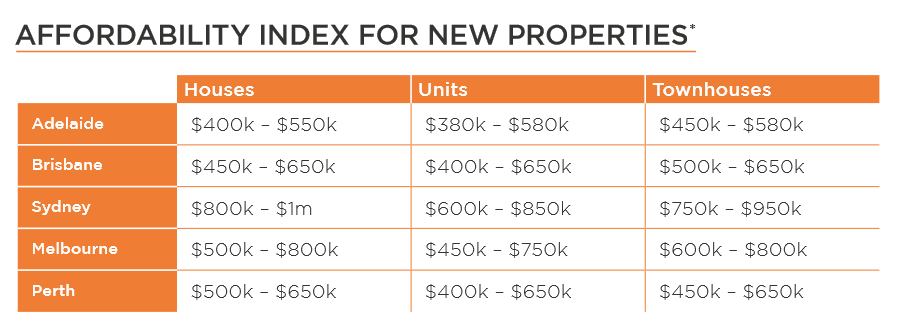

There is no point looking for a penthouse in New York if your budget is $300,000! Understand your limits and look for what you can afford. The table below is a good guide to understanding what your money may be able to buy in each city.

You should also factor in the different costs of ownership in different cities, as each state has different stamp duty rates, and also different thresholds for land tax payable. By diversifying your portfolio you can limit land tax payable – although this shouldn’t be the main driver for your investment strategy, it is certainly a benefit of diversification.

Take the emotion out of your investment

Buying investment property is, of course, an inherently different type of decision to buying your own home. Remember that the things you may love about living in a particular type, size or location of a property may be very different to what others may value in their local city. Stay focused on the research, and of course, make sure that the fundamentals of the property are sound – that you are investing in quality.

Get the support of a good team

The challenges of investing with confidence in another city or state can feel insurmountable when you’re doing it on your own. That’s why it’s important to get the support of a team of professionals who can help to guide you through the process. We know the importance of local knowledge when it comes to property investment, and as an investor you can leverage our national network of 9 offices located across the 5 major Australian capital cities. Also ensure that you have a great solicitor, accountant and mortgage broker on your team – with the right support in place, investing in another city is well within reach.

If you’re interested in buying investment property and would like more information on interstate property markets, you can download our national residential property report “My Market.”

Or if you would like specific reports about each of the major Australian property markets (Sydney, Melbourne, Brisbane, Adelaide and Perth), please contact your local strategist who will be able to give you a copy of the relevant “MyCity” report.