Should I invest in property in 2018 or wait a year?

SPONSORED POST

In a year that has had its fair share of challenges – as well as opportunities – this end of financial year, I thought I would take the time to share my own property investment strategies and some tips to succeed within the current market and lending environment.

My FY 2018 property investment strategy

Last year, I said I was going to leave residential property investment for a while, as I have already achieved my goals. But when I spotted an opportunity, I couldn’t help myself.

This financial year, I’ve invested heavily in Brisbane and South East Queensland (SEQ); I’ve purchased some more properties and also settled a few. This is part of my long-term strategy but also to invest at the right time of the cycle – as in my experience the property market in SEQ is around half a cycle behind Sydney and Melbourne.

SEQ is also a major growth corridor, which is experiencing record levels of interstate migration, infrastructure investment – and then there’s the Commonwealth Games which has put the Gold Coast on the world map as well. I saw a great opportunity, so I’ve personally invested there.

In the last few years, Queensland at its peak had about 50 – 60 new residential developments in a single year, and we’re now down to single digits. Now only a handful of truly strong developers are able to bring anything off the ground. So it’s worth keeping this in mind.

Get into Perth

I’m also continuing my investment in Perth and Adelaide. I feel like the Perth market has bottomed out and it’s a great opportunity now to invest, not just for myself personally, but we’re looking closely for our Ironfish investors as well.

When property values start going up, most people aren’t aware of all the underlying factors that tend to drive prices up. For example, I also invest in shares, and I’ve noticed that my investments in mining stock have actually fared better than before. At the end of last year, there was also an industry report that suggested the mining downturn has come to an end – with higher prices reported across the board.

Warren Buffett once said, that as an investor it is wise to be “Fearful when others are greedy and greedy when others are fearful.” I tend to stick to this motto. Most people will wait for 3-4 years when the market is really booming to get on board, and that’s already too late to get the biggest gains.

While it might still be a little bit early for some investors, for long-term investors, one thing is for sure: you’re not going to miss out. Get into Perth!

Top investment tips for Sydney

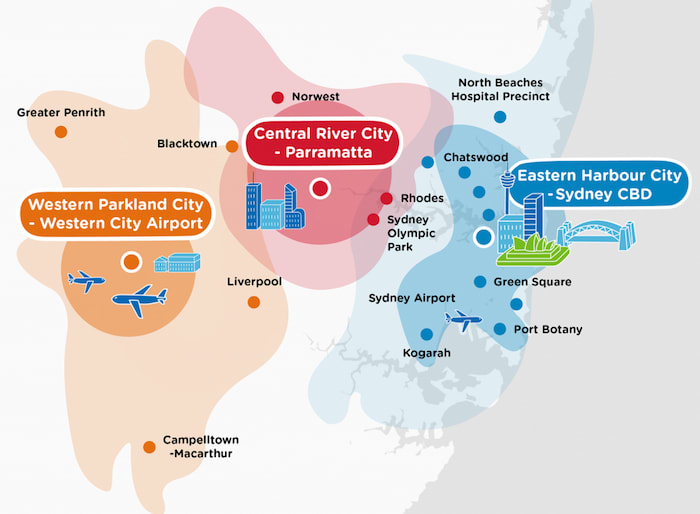

This year I’ve also bought a little bit in Sydney. Although the market has slowed down, there are still pockets of opportunity in Sydney’s west, for example, with the 2nd airport coming in. But you do need to be careful. Be very strategic and almost fanatical when it comes to investing in Sydney and to some extent, Melbourne.

The goal I didn’t meet

I was hoping to acquire a substantial commercial investment property this financial year. I’ve been looking in Sydney and Melbourne, but haven’t been able to find the right property, with returns being relatively low. Since I’m in my mid-50s, I’m moving gradually from capital growth to income as my main strategy, so I’m starting to put my money into these types of investments. But I’ve put my feelers out there and I’m more serious than ever to make this investment, so we will see!

Looking ahead to 2019:

Key market challenges – and how to meet them

Market confidence

One of the key challenges for any investor is confidence. When things are rosy, when all you hear are good stories from friends, from the media, when you’re experiencing capital growth – this is what will encourage many investors to enter the property market, or stay in the market.

With the Sydney market posting negative growth, albeit a small percentage, there’s plenty of negative or gloomy sentiment in the market. But for long-term investors, if you have the money to buy the right property in the right location, if you have the ability to hold that property and service your loan over the long term – then you shouldn’t be deterred. It’s about thinking where you’ll be or where you want to be financially in 15+ years’ time.

Lending

With the Royal Commission, and tightened investor lending, (though there has been some loosening up as well, with some interest only loans extended or advanced) banks require more documentation and people need greater qualification to borrow money to invest. Which means people need to make sure they are being prudent when they go to make a purchase. It’s important to speak to multiple financiers and ensure you have enough buffer in your equity, savings or serviceability so that you can settle.

I remember in the last few years of the Sydney boom, people would go with whichever broker, or bank manager who would lend them money. Now you really need people who understand the bigger picture, you probably need a more senior, more experienced professional to strategise within your mortgage and structure.

That said, it’s still easier than way back when I first started as an investor!

Selecting the right property

Investors need to be a lot more selective when it comes to choosing a property within the current market. People need to be more wary of inferior quality developments and stick to properties that have strong owner-occupier appeal. When you’re aiming for capital growth, properties designed for owner occupiers will appeal to a wider spectrum of buyers – so if you decide to sell, you can access the whole market, not just investors.

4 tips and trends to watch

More non-bank lenders

With major banks tightening up on lending, this has opened an opportunity for more non-bank lenders to come and fill the space and meet the needs of the market. It’s something that happened in the last cycle – that could happen again. It’s a trend we’ve already seen, for example, with FIRB lending, with more and more mortgage funds coming in to fill some of the gap.

Look for areas that have yet to boom

It’s important to note that the so-called ‘boom’ has really only happened in Sydney and Melbourne. And while these markets may be slowing, there are others performing very well – such as Hobart. I also believe very strongly in Brisbane, with Perth and Adelaide typically following, based on historical records. At the peak of its last cycle, the Perth median price was getting close to Sydney median price. Gold Coast at peak of last cycle almost equal to Sydney.

And while Melbourne houses have done better than Sydney in recent years, I think Melbourne apartments will catch up, with recent planning changes and reduced supply of new developments.

Prepare well for settlement

For off-the-plan investors who have already purchased, speak to a number of brokers, prepare enough buffers to ensure you can settle. For new investors, when you go into a new building, make sure you are confident with the track record of the developer.

Gather your team

Though the economy is strong, we are in a relatively uncertain period in terms of lending. So, now more than ever, people need to have the right team around them. Experienced people from different fields with their best interests at heart and who are positive – who don’t give up easily.

When faced with a challenge, many people look for easy way out. But consider this, if you plan to give up on your property investment, what alternatives are there? Because fact of the matter is, so many Australians will not have enough saved for retirement. So now is the perfect time to learn more, to become more financially literate so you can be better prepared for your future.

It’s easy in the ‘post-truth’ era to be swayed by others, or by incredible stories of overnight cryptocurrency billionaires. But the fact is, investment isn’t speculative. For us at Ironfish, it is about common sense: acquiring a portfolio of quality properties in a great location and holding it over the long-term.

To borrow another piece of wisdom from Mr Buffett: “If you aren’t willing to own a stock for 10 years, don’t even bother holding it for 10 days.”

It’s the same with property; people may make money in the short term through sheer luck, but investing is a long-game, and there will always be challenges. That’s why we’re here to help you every step of the way.

Joseph Chou is the founder and CEO of property investment firm Ironfish.