Local demand insufficient to get projects across the line as offshore apartment buyers dry up: Pete Wargent

Pete WargentDecember 17, 2020

EXPERT OBSERVATION

The Foreign Investment Review Board (FIRB) released its Annual Report for the 2017 financial year, and as expected it showed that investment in new apartments from mainland Chinese investors has been annihilated by a combination of fee charges and tighter capital controls.

There's much more to the Annual Report than just the residential real estate investment aspect, of course, but this is a blog not an Encyclopaedia Britannica so let's crack straight into it.

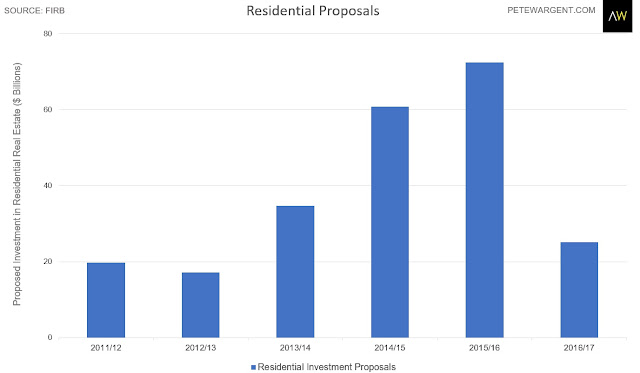

Although the impact on total foreign investment was played down in the report, the reality is that the number of residential approvals have been smoked, down by 67 per cent from the prior year.

Similarly the value of residential approvals crashed 65 per cent lower from $72.4 billion to $25.2 billion.

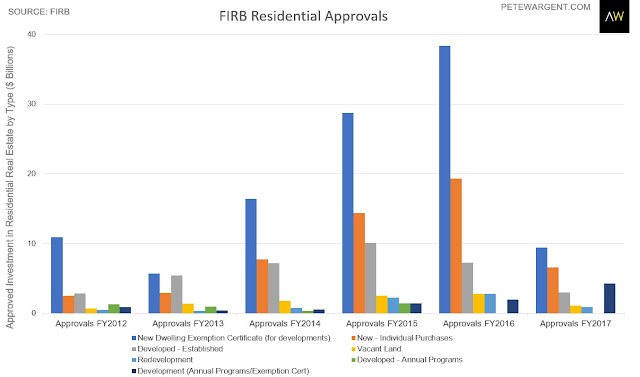

The bulk of new approvals through this unprecedented cycle have been for new dwelling exemption certificates, mainly for Chinese investors.

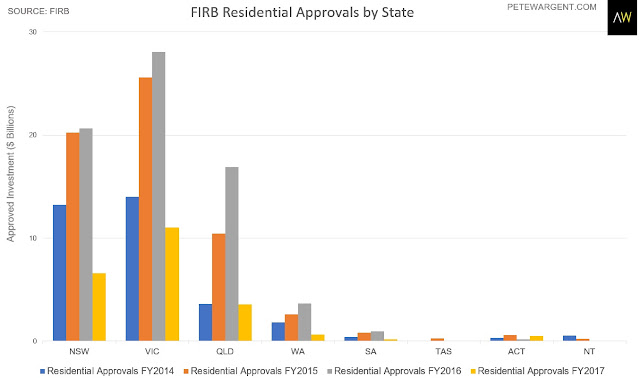

Looking at these numbers it's not hard to understand how Sydney now has more apartments approved but not yet commenced than at any time in its history, as detailed here previously.

The offshore buyers have dried up, demand from domestic investors has been stymied, and the demand from owner-occupiers is insufficient to get new development project finance across the line.

Statistically it appears to be a certainty that Sydney will experience the greatest number of failed apartment projects as these trends flow through.

I expect to see plenty of apartment projects stalling, and increasing signs of discounting on new Sydney apartments.

Perhaps this was an inevitable end-game for this cycle, where development has been too much skewed towards apartments for investors, and too little towards the types of medium-density dwellings that people want to reside in.

Perhaps this was an inevitable end-game for this cycle, where development has been too much skewed towards apartments for investors, and too little towards the types of medium-density dwellings that people want to reside in.

The wrap

As noted, there is much more to foreign investment than just new apartment purchases, with total investment of $168 billion only 4 per cent below the level seen in the prior year.

And indeed, investment in manufacturing, agriculture, ports, other commercial real estate, and resources has catapulted China to become by far and away the greatest investor in Australia at $38.9 billion in FY2017, miles ahead of the United States in second place at $26.5 billion.

Nevertheless, these figures will have some significant impacts on the new apartment sector, construction trends, and the broader economy - and especially so in Sydney.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.