As usual vacancy rates were higher in the month of December at 2.5 per cent or 80,092 vacancies.

Despite the record high level of building, vacancies were considerably lower than a year earlier, when there were 89,721 vacancies according to SQM Research figures.

The year-on-year decrease reflects a combination of strong population growth and a very high volume of higher-density apartments still under construction, there being a lag in the completion of this dwelling type.

The year-on-year decrease reflects a combination of strong population growth and a very high volume of higher-density apartments still under construction, there being a lag in the completion of this dwelling type.

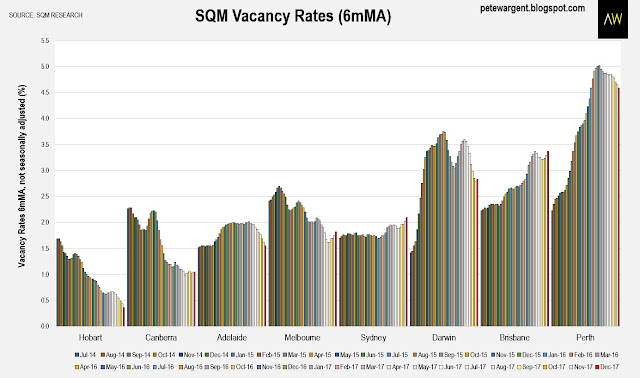

Hobart has a record low vacancy rate for any capital city of an extremely tight 0.3 per cent, while Canberra (1.3 per cent) and Adelaide (1.5 per cent) remain tight rental markets.

Perth and Darwin also seem to have turned a corner, with vacancy rates well down from a year earlier, while Melbourne's 2.1 per cent vacancy rate was also well down from 2.4 per cent in December 2016.

This downtrend wasn't the case everywhere however, with Sydney recording a multi-year high reading of 2.6 per cent in December, up from 2.3 per cent last year.

The numbers can jag around a bit, but smoothing the figures on a 6mMA basis gives a sense of the relative condition of the rental market in each city and the prevailing trends.

At the end of the 2017 financial year, New South Wales had a record 64,470 attached dwellings under construction, with the overdue flood of completions doubtless accounting for the jump in December.

Population growth in Sydney nevertheless remains strong, so it will be interesting to see how the market fares in 2018.

On that note, the latest building activity figures are due out today, and these will shed further light on completions and the pipeline remaining under construction.