Pace of NSW investor lending accelerates: Pete Wargent

The Lending Finance data released yesterday for the month of June 2015.

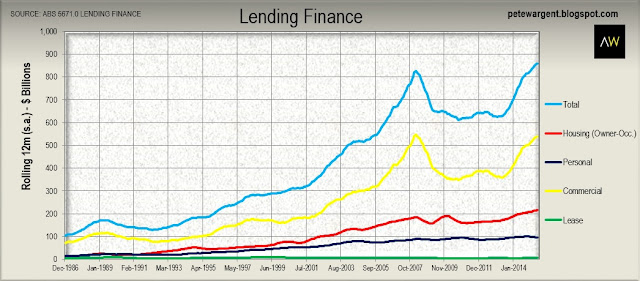

Total lending was once again superficially very strong at a seasonally adjusted $74.7 billion for the month.

While this was only a moderate increase for the month, on a rolling annual basis total lending has increased to a new high of $857 billion.

While this was only a moderate increase for the month, on a rolling annual basis total lending has increased to a new high of $857 billion.

Note that the "commercial loans" category includes property investment loans, so the recovery in credit growth is rather more housing-focused than first it may appear.

nvestor loans - Sydney investor credit explodes

Drilling into the commercial lending figures we can see that the property investment loans by state data is telling.

Up until the month of June, while the investor loan crackdown by the regulator APRA may have had an impact in aggregate, investor lending in Sydney was still rising fast.

In fact, New South Wales investor loans accelerated in June to a record $6.55 billion to record a rolling annual total of an astounding $64.9 billion.

Thus while investor lending growth in aggregate had begun to slow by June, Sydney investors are now sitting on deep pools of equity following years of strong capital growth and this equity can often be used as 20 per cent deposits.

As a result as this stage investor loans may have been more impacted in other capital cities and regional centres where capital growth has been much weaker or in many cases non-existent.

As a result as this stage investor loans may have been more impacted in other capital cities and regional centres where capital growth has been much weaker or in many cases non-existent.

My information is that we should start to see investor loans slowing in the July and particularly August figures.

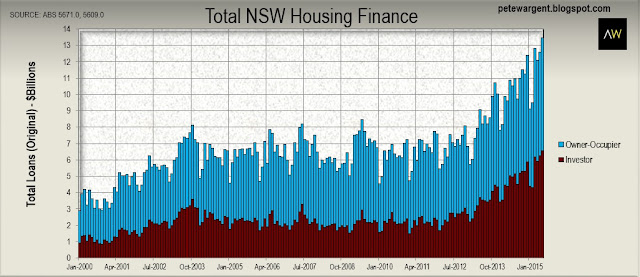

However, as I looked at last week, the housing finance data also shows that owner-occupier commitments in New South Wales have now responded to low interest rates in booming to a record high $6.6 billion on a seasonally adjusted basis in June.

Housing markets are the sum of their parts and therefore below I have charted the raw unadjusted "Original" data for New South Wales in a stacked columnar format.

As you can see in the chart below, the month of June was by a significant margin the biggest month of lending on record for any state in Australia's history.

A couple of observations here.

Recall that foreign buyers without Australian residency are generally granted permission to buy new residential property.

As the above chart clearly shows there is more than enough domestic business from Australian residents without needing to seek business from buyers without Australian residency.

Around the states

Firstly, note that the ABS Lending Finance data series records loans written domestically, suggesting that the boom in Sydney dwelling prices has been primarily driven by domestic investors (and now homebuyers).

That said, foreign capital is playing its part to some extent too, as I've written here previously, particularly relating to new dwellings.

Recall that foreign buyers without Australian residency are generally granted permission to buy new residential property.

Foreign buyers with no Australian residency typically cannot buy established residential property unless they have specific permission to do so from the Foreign Investment Review Board (FIRB).

This permission may be granted in some instances, such as for development projects.

Licensed real estate agents, buyers agents and solicitors have simple procedures in place to ensure that they only deal with legal purchasers of established property.

As the above chart clearly shows there is more than enough domestic business from Australian residents without needing to seek business from buyers without Australian residency.

Around the states

As noted above New South Wales investor loans accelerated in June to a new high of $6.5 billion in June.

On a 12mMA basis investor loans in New South Wales rose to a record high $5.4 billion.

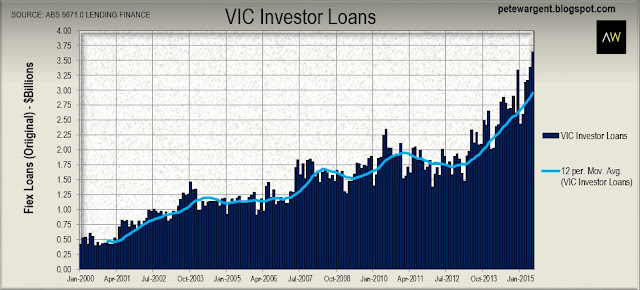

Low interest rates and expectations of future price growth have also impacted investor loans in Victoria.

It's impossible to call the market peak accurately, but it's my belief that - unlike Sydney - Melbourne has been overbuilding in the unit and apartment market in particular, and this will result in stagnant rents and prices in due course for certain sectors of the market.

There may be a material price correction in time too, especially for new and off-the-plan builds.

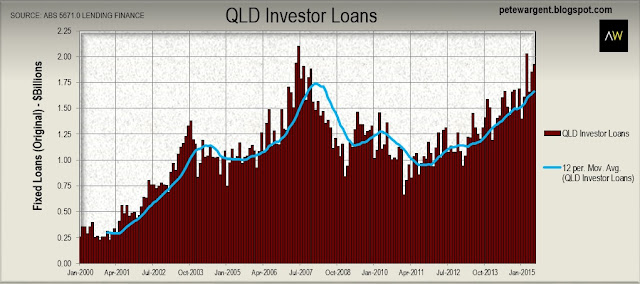

Queensland's resources regions and regional centres may be struggling as the mining investment boom turns to bust, but house prices are now rising in inner Brisbane.

For my money, Brisbane may well be the best performing capital city housing market in 2016, although asset selection will be important here (there is much high-density building taking place).

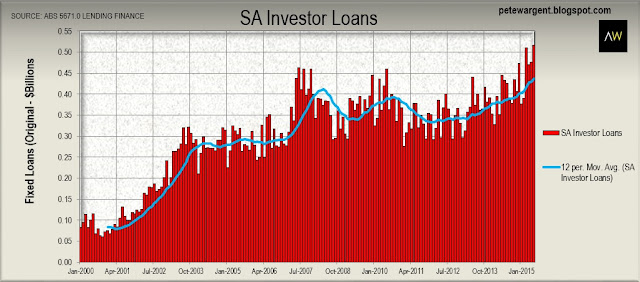

The trendline below which records investor loans on a 12mMA basis shows that Queensland investor lending in aggregate is now tracking at their highest level since April 2008.

Western Australia's property markets are now demonstrably into their downturn phase, and consequently despite low interest rates investor loans volumes are trending down.

Some property experts have painted themselves into a corner with regards to South Australia and will continue to recommend investing there come hell of high water.

With very little building activity in the detached housing sector the Adelaide market has certainly been tightening nicely, yields are comparatively strong, and after 7 or 8 years of weak dwelling price growth there is plenty of value of money to be found, even close to the centre of Adelaide.

On a 12mMA basis investor loans in South Australia are now tracking at their highest ever level at $437 million.

A word of warning, however,

Barely a week passes without further news of redundancies in South Australia, with the unemployment rate having trended up alarmingly from 5.2 per cent in October 2011 to 7.9 per cent today...and rising.

In fact, if you have a low budget, my personal belief is that a combination of foreign capital, a n ongoing depreciation of the Aussie dollar, record Chinese tourism spend and a tightening market will see Hobart emerge as the surprise package capital city housing market over the short term.

The longer term economic and demographic fundamentals in Tasmania are admittedly uncertain.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.