Statistics fatigue

I've been suffering from quite heavily from a case of DSF recently - Demographic Statistics Fatigue.

After putting the data series on hold for months, the statistics bureau has been releasing monthly data in rapid-fire succession in recent weeks.

A bit like London buses, you wait seemingly ages for one to come along, and then...

Rather than re-cap on old ground too much, I'll just make four short observations here, starting with...

1 - Migration slowing

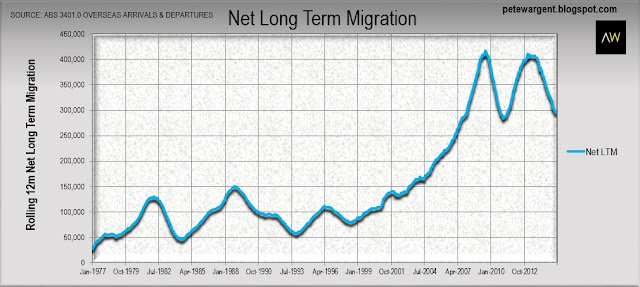

Firstly, net overseas migration on a rolling annual basis has continued to slow through 2015.

With the economy moving through something of a sticky patch, population growth in Australia slowed from a massive 396,200 in calendar year 2013 to a somewhat more sedate 330,200 in 2014.

The latest figures suggest that net overseas migration into Australia will be slower again in 2015.

Click to enlarge

While property observers in particular seem to love to see rampant headcount growth at any cost, the reduced population growth rate of 1.4 per cent that we have seen through 2014 has had one major benefit in particular.

And that benefit is that over past year the economy has been stacking on new jobs faster - much faster - than the rate of population growth - with an employment growth rate of 1.9 per cent, or just shy of 225,000 new jobs.

Indeed, since October alone the economy has added more than 205,000 new jobs, which in turn has seen the rate of total employment growth over recent months romping along at nearly twice the rate of the growth in population.

Perhaps unsurprisingly, therefore, the unemployment rate has fallen from 6.3% at the beginning of the year to 6.0 per cent.

The latest Reserve Bank Board Meeting Minutes suggested that we may even see the unemployment rate falling further from this point, thereby contradicting earlier forecasts which had expected unemployment to run up to a peak of 6.5% in this cycle.

And long may this particular dynamic continue.

You can read more about employment growth and where it is (and isn't) taking place in Australia here.

2 - Rebalancing underway

The Australian dollar has now declined from a mining-boom-inspired peak of around 110 US cents to below 74 cents.

It seems likely that the Aussie dollar will need to fall further too, in order to help the rebalancing of the economy.

This depreciation of the currency will have a major impact on demographic trends.

In short, fewer and fewer Aussies will be inclined to travel and holiday overseas, while more and more folk from foreign fields will see Australia as an attractive destination for a visit.

Indeed, this enormous benefit to the tourism services industry is already well underway.

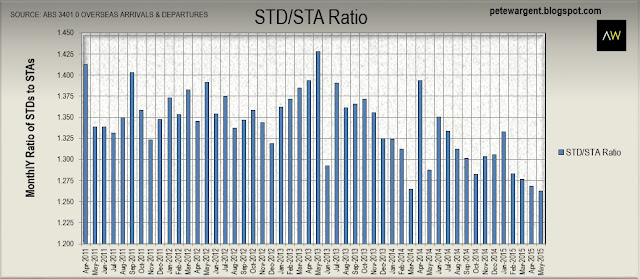

While it may sound like jargon, the ratio of short term departures to short term arrivals has declined to its lowest level in years.

In plain English, more tourists are now coming to Oz, and fewer Aussies are taking overseas trips.

Click to enlarge

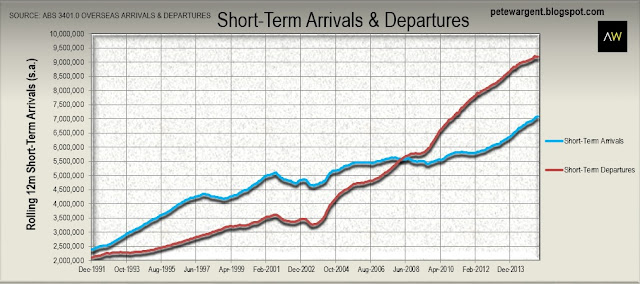

Looked at another way, the number of short term arrivals into Australia has blazed well past 7 million for the first time on record.

And while the tide has only turned slowly to date, fewer Aussies are now electing to take overseas trips.

The two lines representing these trends on the chart will meet again, possibly sooner than we think, and in time Australia will once again see a net inflow of short term demographic movements.

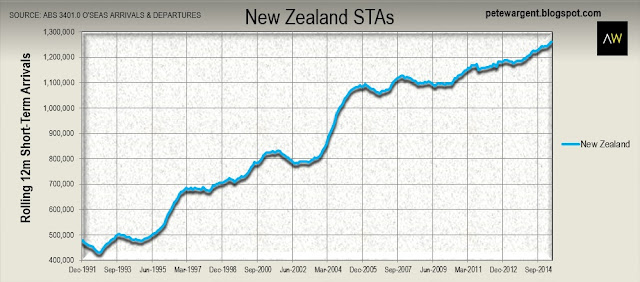

3 - Chinese...and Kiwi visitors!

The most notable of all demographic trends has been the incredible explosion in Chinese visitors to Australia, an obvious precursor to what lies ahead in terms of permanent migration.

Over the last year there have been 1.25 million visitors from China, Hong Kong and Taiwan, and the latest data suggests that these extraordinary figures are set to accelerate plenty higher still in due course.

Click to enlarge

Chinese migrants are settling in Australia too, with 18,550 settlers in the year to May - essentially as high a figure as we have seen to date - while there were also a record 19,930 settlers hailing from India over the same 12 month period.

Watch this space, as these numbers are growing apace.

Indeed, the number of settlers hailing from Asia is now overwhelming compared to the numbers from all other continents - outnumbering European migrants by a ratio of five to one, for example.

Much has been made of the rapidly diminishing numbers of settlers from Oceania (essentially New Zealand), with permanent migrants effectively having halved since 2012.

There are also ever fewer Britons emigrating to Australia at present as the UK economy has become an "incredible job-creating machine" over the past few years.

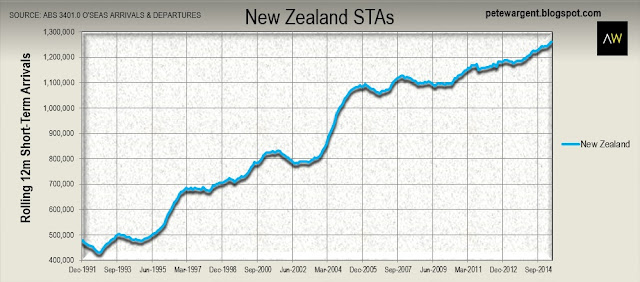

For all that, it's worth noting that there were well over 1.25 million short-term arrivals from New Zealand over the past year - a record high - so it's hardly all one way traffic, bro.

At the same time there were also a record 567,100 American visitors enjoying the turnaround in exchange rate in Australia over the past year...the delayed Oprah effect.

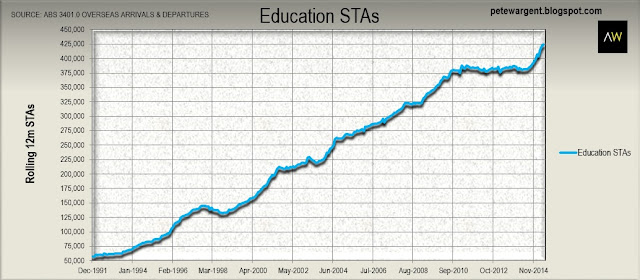

4 - Record foreign students

Recent data from Reserve Bank of Australia (RBA) liaison projects a huge ramp up in the number of foreign students in Australia over the years ahead, one of Australia's fast-growing "export" industries.

In fact, this is already happening, with Chinese students playing a major role here too.

The first quarter of 2015 witnessed record enrolments of foreign students in Australia.

Click to enlarge

The RBA data also confirmed that most foreign students are overwhelmingly bound for

Sydney and

Melbourne.

The wrap

The main themes here are that we can expect population growth in 2015 again to be slower than it has been in recent years.

This slowdon has clearly had a positive effect on the unemployment rate to date, and it is hoped that if the economy continues to add jobs at the pace it has been since October the unemployment rate may fall into a range with a "5 handle".

The other obvious theme here which stands out is the sheer dominance of migration from Asia, a story which is only set to grow in Australia over the decades ahead.

The role of Chinese investment in Australia in particular is set to be very material over the next five years.