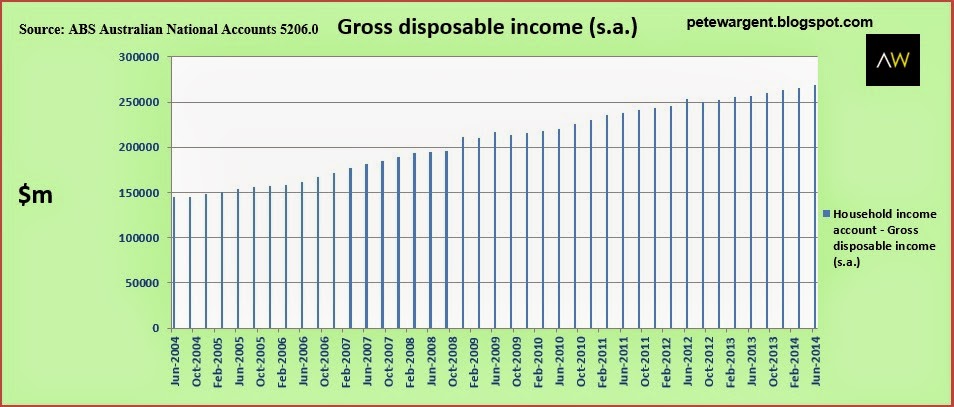

Are household disposable incomes really increasing at 4.7%?

Last week, I noticed Craig James, chief economist of Commsec, pointing out to David "Kochie" Koch that although wages growing have been growing slower than prices, household incomes are actually growing at the fastest pace in two years, increasing by 4.7% in the last 12 months.

While wages growth has indeed slowed (as I analysed here, among other places), apparently household disposable incomes have been rising more quickly. Interesting statistic I thought, so I asked "CJ" for the source.

Straight from the National Accounts, advised CJ. So I thought I'd take a little look to confirm or deny.

Household gross incomes rising

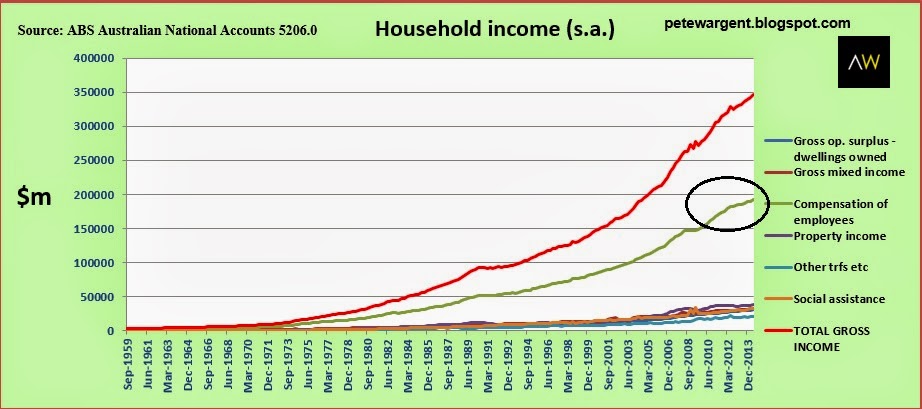

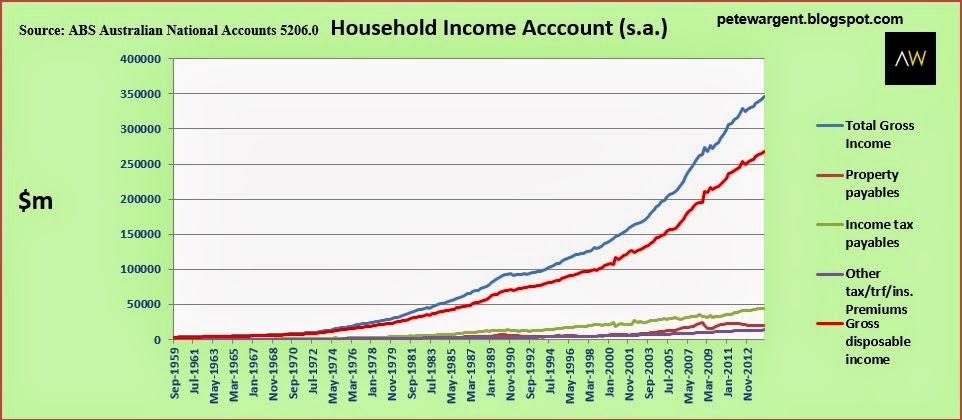

First, I ran the seasonally adjusted household income data from the National Accounts.

As you can see from the green line circled below, after a rampant boom in employee compensation spurred on by Australia's mining boom, income growth from paid employment has slowed since December 2012.

Although the trend does remain up on a national basis, in real terms wages are at best flat and at worst declining moderately.

Of course there are many forms of income including dividends, rent, social assistance, other transfers, and more besides, and overall household incomes have increased at the significantly faster pace of 4.4% seasonally adjusted over the last year according to the Australian Bureau of Statistics (ABS) - in essence, everything that is not wages has increased in real terms.

Still, even this income growth cannot fully account for a 4.7% rise in household disposable incomes.

Payables down?

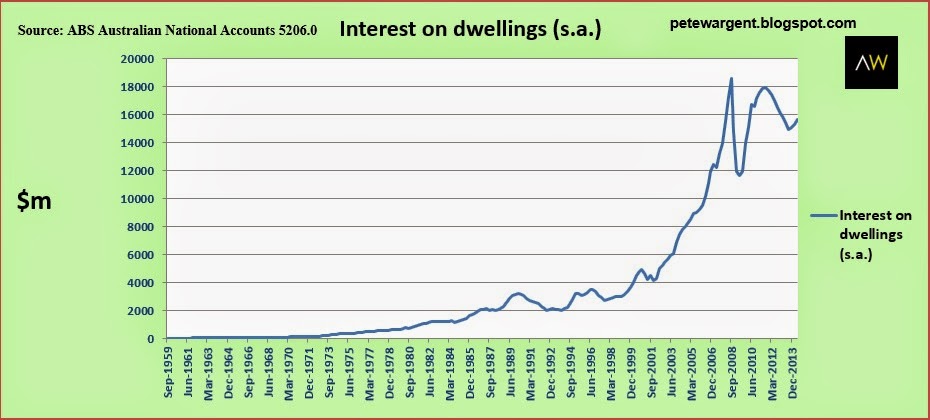

The big mover in terms of payables in recent decades has of course been interest paid on dwellings, which skyrocketed until September 2008, then collapsed as interest rates were slashed and house prices eased. Then it repeated the trick once again from September 2011 as the latest easing cycle took hold.

With interest rates significantly closer to the zero bound than historically has been the case and household debt levels today much higher than they were before the deregulation of the banking system, relatively small adjustments to mortgage rates can result in wild swings in total interest payments on dwellings. And how!

With most mortgage debt being charged on variable rate products, this explains why Australia's housing market is so sensitive to shifts in interest rates, and why only a few rate hikes would quickly quell speculative sentiment and swiftly end the property price uptrend for this cycle.

Why? Because the people lumbered with the highest mortgage debt as a percentage of their household income are those at the margin i.e. those buying much of the property which transacts.

It is difficult to draw hard conclusions from macro level data, but the two charts above show that for existing homeowners on variable rate mortgages, disposable income has surely roared higher in the period since the dramatic peaks in interest repayment levels of September 2008 and September 2011 respectively.

Anyone with existing mortgage debt who has remained in employment will appreciate just how comparatively easy life is with a standard variable rate of 5.2% rather than the 9.6%, we saw as recently as July and August 2008.

This article continues on the next page. Please click below to continue.

Household income accounts

On a national basis total gross income dwarfs property payables largely because most Australians are not mortgaged to the eyeballs as is widely believed.

Depending on your state, between a quarter and a third of homes are owned debt free while mortgage holders over recent years have been moving well ahead on their repayments.

Meanwhile income taxes payable have moved higher in concert with rising taxable incomes.

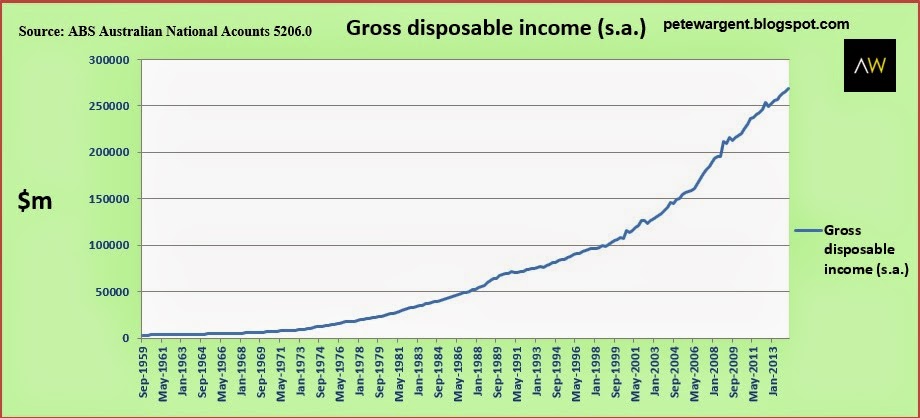

The trend in gross disposable income is shown by the red line below.

So, in this sense, Commsec's observation is correct - gross disposable incomes are indeed 4.7% higher than a year ago.

However it is a fair bet that those who are not homeowners and are 100 percent reliant on a salary for their income do not feel much better off, if they even do at all.

Homeowners and in some instances those with diversified income streams are clearly benefiting very significantly from record low borrowing rates.

These things naturally tend to work in cycles, though - when interest rates were much higher and rising and dwelling prices easing, the boot was on the other foot entirely.

Gross disposable income nationally has been launched massively higher by more than 80% in the past decade, unadjusted for population growth.

However, the trend disposable income growth per capita seems likely to slow, and if interest rates are hiked several times gross disposable income in aggregate could plateau unless wages growth rebounds.