Responsible lending laws to be wound back: Pete Wargent

EXPERT OBSERVER

A significant day for bank stocks as it was announced that the responsible lending laws that have been in place since 2009 will likely be wound back.

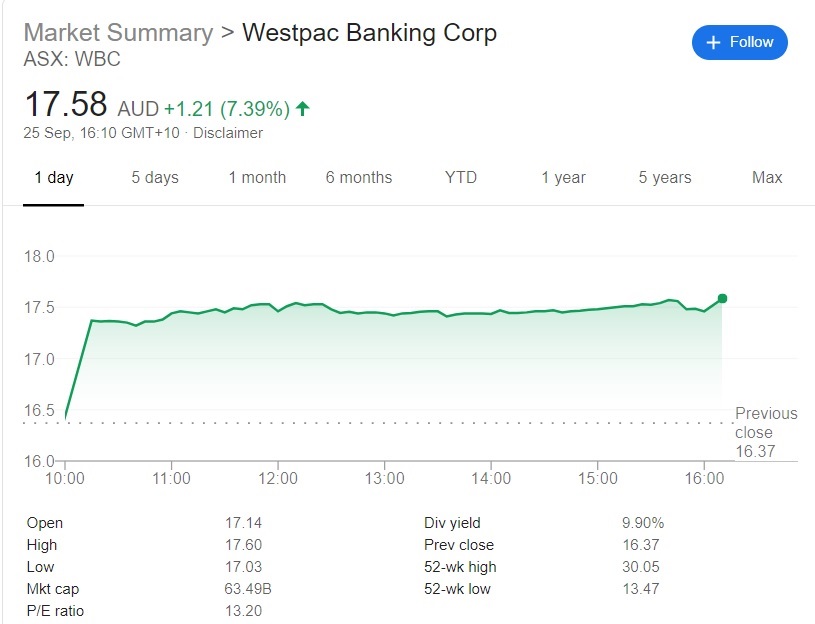

All of the major lenders saw a significant jump in their stock prices.

This will no doubt act to speed up the pace of loan approvals and bank lending, albeit probably not for 6-12 months, with less of the forensic poring over household expenditure for mortgage applications, which has at times made the lending process more akin to an audit than a credit approval.

Most likely there will be an easing of some of the existing HEM restrictions as the legislation is passed, and less scrutiny of household expenditure line items.

The responsibility will more so fall back on to borrowers to declare complete and accurate information, instead of looking for lenders or brokers to blame wherever a loan goes bad.

This may also increase the availability and capacity for some individuals to borrow, though it remains to be seen how much.

Offsetting this to some extent will be the introduction of the best interests duty for brokers, effective 1 January 2021.

The Reserve Bank had previously noted that lending had become excessively risk averse, and this move will slash approval times assuming it is legislated on a timely basis.

Symbolic shift

Moreover, the announced planned changes are symbolic, suggesting that the credit pendulum is now likely set to swing back in the other direction, after half a decade of tightening which reduced the total borrowing capacity of some borrowers by half.

The announcement will also foster more competition between banks, with one large lender immediately offering lower variable rates, including on investment loans.

There are still significant headwinds for the economy to be navigated, of course, but the combination of record low mortgage rates and the signaling of a simplified approval process should bring the housing market back to life in 2021.

PETE WARGENT is the co-founder of AllenWargent property buyers and a best-selling author and blogger