Will investors hold or sell in this troubled time? Pete Wargent

You should never judge a 20-30 year investment on what's happening right now, but it's nevertheless worth taking a look at the current state of play.

With the Airbnb sector effectively shuttered at the present time some areas have seen a 5 to 10 per cent jump in rental listings as landlords seek tenants, especially in areas that are generally popular with students, holidaymakers, or short-stay lets.

With the borders also effectively closed to New Zealanders, tourists from China and India, and international students, there's likely to be a scramble for tenants over the coming months.

On the flip side, of course, Aussies aren't heading overseas either, so the net effect is less pronounced.

The New South Wales State Government looks set to do its part with the apartment overhang by buying up unsold new apartments from developers.

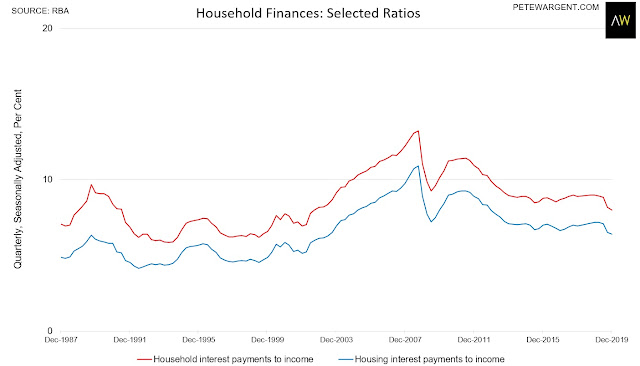

The latest figures aren't available yet, but when they are they'll probably show that interest cost serviceability is back to where it was about 35 years ago.

Some of the 'rack rate' variable mortgage rates are still unreasonably high for investors, but for those taking a moment to shop around rates may now be very low indeed.

The detailed Australian Taxation Office statistics do show that many of those investors aged between 30 and 60 choose to hold an investment property with a reportable net rental loss of between $5,000 and $10,000 per annum, partly to reduce their income tax payable.

Depreciation report (MCG)

These investors tend to receive very significant depreciation benefits, but I expect there will many investors in this cohort facing negative equity as brand new property tends to...well, depreciate.

But the number of forced sellers will be lower than otherwise would've been the case due to record low mortgage rates, while borrowers have also been extended the option to switch to interest-only loans or take a 6-month repayment holiday.