Pete WargentDecember 17, 2020

EXPERT OBSERVER

A quick look at today's arrivals and departures figures.

Well, it's a bit like the famous old chart chronicling 1,001 days in the well-being of a Thanksgiving turkey.

Chinese short-term arrivals into Australia fell to a seasonally adjusted total of just 19,500 in February, to be down by about 90 per cent.

Ouch.

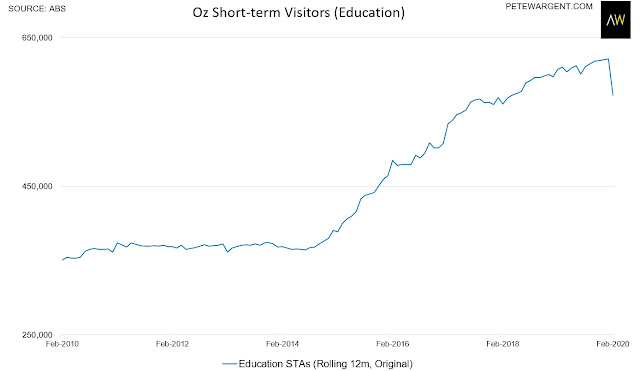

There were still some 72,500 international arrivals for the purposes of education in the month, but February is normally one of the two months of the year wherein far higher numbers are expected, as students are typically expected to return from their Xmas break.

And it was not so this year, as many international students were stuck in China or elsewhere.

Australia has long seen its economy juiced by relatively high intake resulting from net overseas migration, international students, and tourism from China and other parts of Asia.

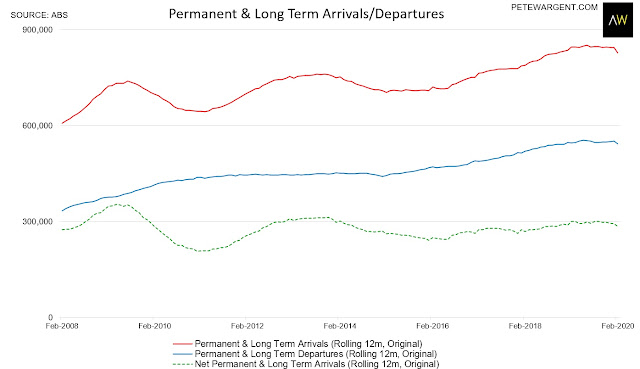

To date, there's been less impact showing up in the figures for permanent and long-term movements.

Indeed, there were still some 97,840 permanent and long term arrivals in the month, and only 32,930 long-term departures, although the next intake is often higher than this in sunny February.

These figures will naturally slow through the remainder of Q1 and Q2, however.

Thus while the economy might see a staged re-entry to business trading, things can't really 'return to normal' until the borders can be opened again, which must obviously take time.

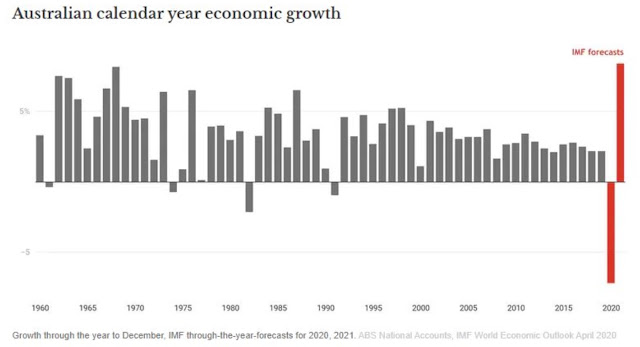

Out of interest, the IMF is forecasting a very strong rebound for Australia's economy in 2021 - faster than the US, UK, Germany, Canada, or France - though how they actually arrived at these figure is anyone's guess.

Source: Joiner, IFM Investors

A sceptic might justifiably ask how their 2020 forecasts are tracking so far...

Listings down

There's not been too much sign of forced selling in the housing market just yet, with new listings all but cut in half.

Source: My Housing Market

Resi construction is also forecast to all but dry up this year, with annual dwelling commencements tipped to dip below 100,000 over the coming quarters (UBS), which would the lowest rate of new supply since 'at least 1960' (h/t Scutty).

In fact, we're still seeing plenty of competition for the limited amount of new stock in blue chip areas, and even some examples of prices going above price guides.

It's extremely doubtful that's the case in outer suburban areas or regional hubs, though, as rising unemployment and underemployment begin to bite

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.