Housing lending ended 2019 on a high: Pete Wargent

EXPERT OBSERVER

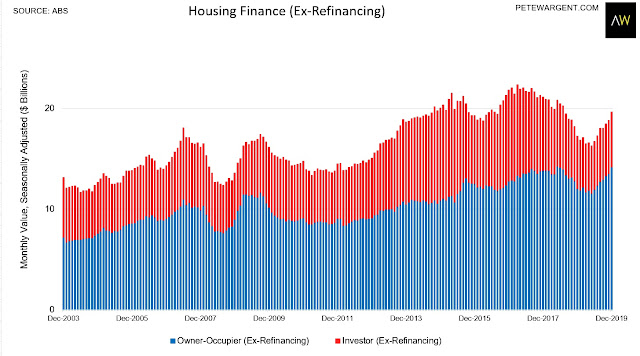

This cemented a robust rebound in lending flows since the election, mainly driven by owner-occupiers (+23 per cent).

Investment loans are also up +15 per cent since the election, but from a very depleted base.

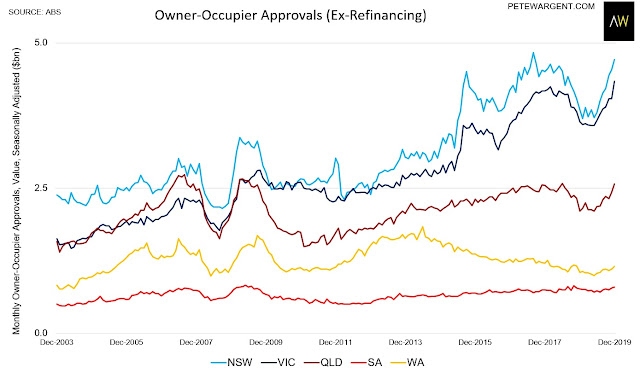

Since the election the rebound in home loans has been driven by New South Wales (+27 per cent), Queensland (+22 per cent), and Victoria (+21 per cent).

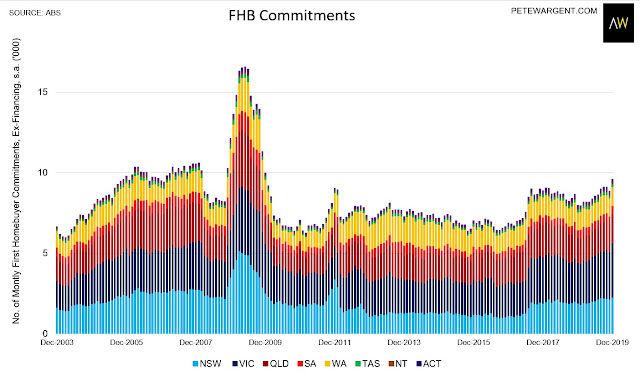

First homebuyer numbers hit decade highs, even ahead of the rapid take-up of the deposit scheme in January.

There was also a big jump in the average loan size to $500,000, but I'm less sure of the integrity of this data trend.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.