Retail turnover declines are woeful: Pete Wargent

EXPERT OBSERVER

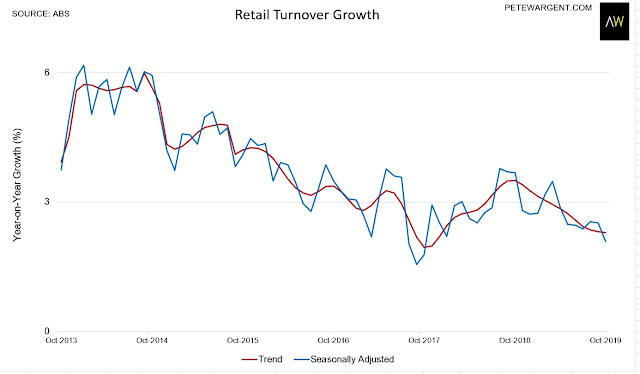

Retail turnover missed expectations of a 0.3 per cent increase in October, instead recording a decline (although the result rounded to 0.0 per cent, after an increase of just 0.2 per cent in September).

The annual turnover increase continued to decline to a 2-year low of just 2.1 per cent.

The monthly decline was driven by clothing and footwear (-0.8 per cent), department stores (-0.8 per cent), and household goods (-0.2 per cent).

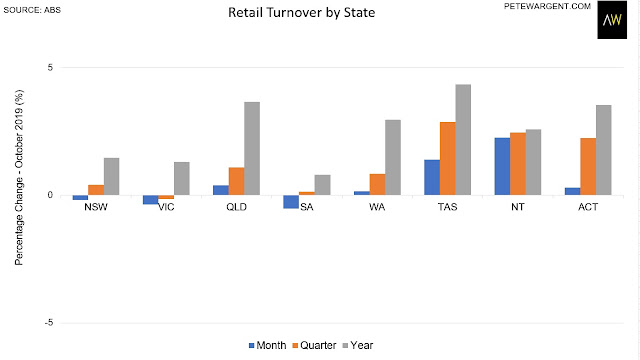

At the state level there were monthly declines in New South Wales and Victoria, as well as in South Australia, perhaps in line with the asymmetric wealth effect thesis.

For excellent analysis of online retail sales from data king James Foster, see here:

'Meanwhile, online retail spending lifted by a healthy 8.5% in October to $1.930bn according to the ABS's estimates to be up by 13.9% over the year.

At 6.5% of total retail turnover, the online segment seems poised to rise to a record high next month on the back of Black Friday sales promotions.'

Overall, though, this was frankly another terrible result, with the only potential (if dubious) 'silver lining' argument being that some savings were being held back for Black Friday and Xmas shopping.

Occam's Razor, but...

This calendar year began with the RBA still talking of the next move in interest rates being up, despite years of below-target inflation.

The experiment could have worked, but now that the central bank forecasts are being shredded the baying mob is growing increasingly restless.

Recent national accounts figures showed a healthy rise in government spending, but private demand sinking into the abyss.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.