November rate cut - and 7.5% house price drop starting in 2016: Macquarie Research

The combination of strong supply and weak population growth means that the housing market has a period of adjustment ahead of it, Macquarie Reseach has forecast.

It says there are three key paths for adjustment to normalise price to income ratios and supply and demand - lower house prices, a decline in new dwelling supply (construction) and a cut in interest rates.

Their overall outlook incorporates all three of these factors, though not to the same degree.

"Lower prices boost affordability, sustaining house price to income ratios as per dwelling incomes decline,' the Macquarie report advised.

"Reductions in dwelling supply stem the decline in the persons per household ratio, pushing up household incomes.

"And interest rates support nominal house price values."

It noted an important distinction about the cycle over the period ahead is that it does not occur against a backdrop of favourable tailwinds.

"Previous housing construction cycles have been associated with some combination of a credit tailwind (rising debt to income ratio), fiscal expansion/tax cuts, participation boost, or major income boost within the economy (price phase of the mining boom).

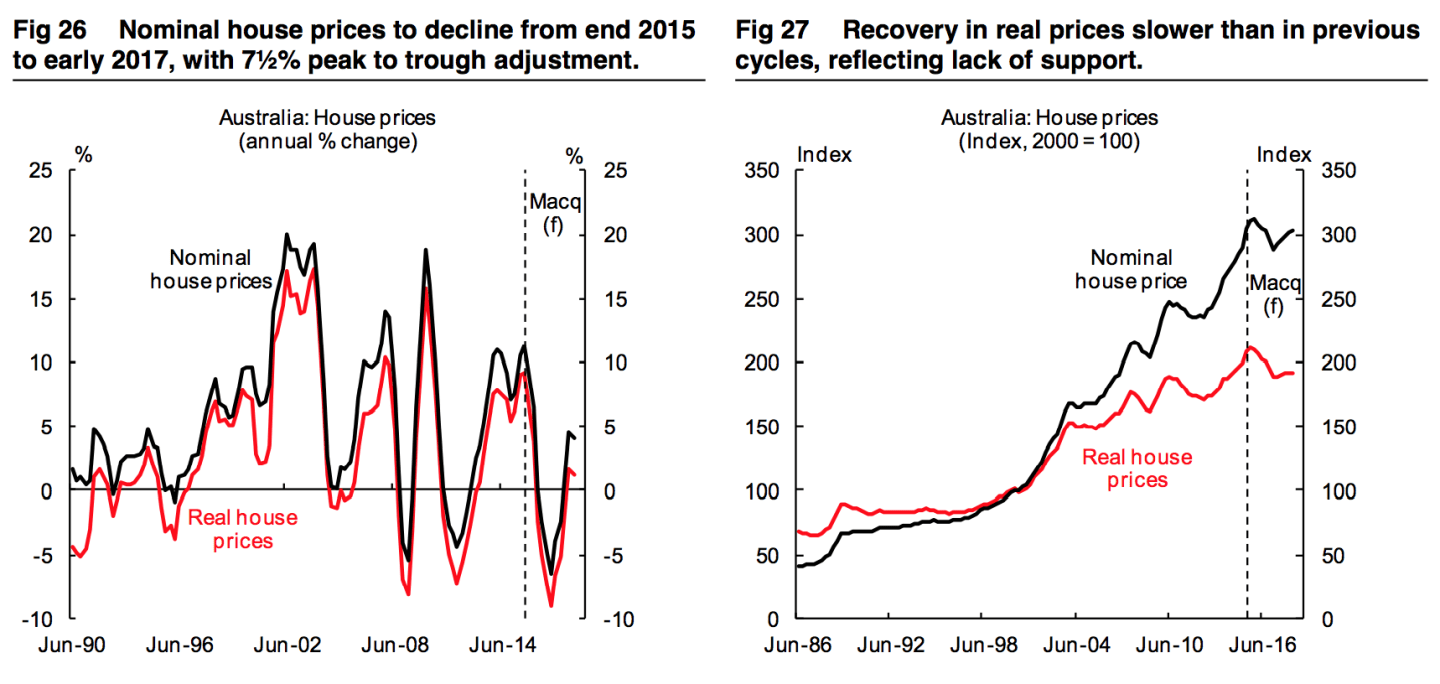

"Through previous cycles, policymakers have managed to avoid large negative house price adjustments – with subsequent destructive effects on household, business and bank balance sheets – and instead used policy to support existing prices, with long, slow adjustments occurring over a number of years.

"For example, in real terms, Sydney house prices peaked in 1Q89, but took almost a decade to exceed that level. The nominal price adjustment was minimal, and was recovered 2 years later. But in real terms, the ABS measure of Sydney house did not better the 1Q89 level until 2Q98 (figure 26 and 27).

"We expect a measured 7.5% peak to trough decline in house prices over 2016 and into 2017, with a recovery commencing in 2H17," was the headline takeout of the report.

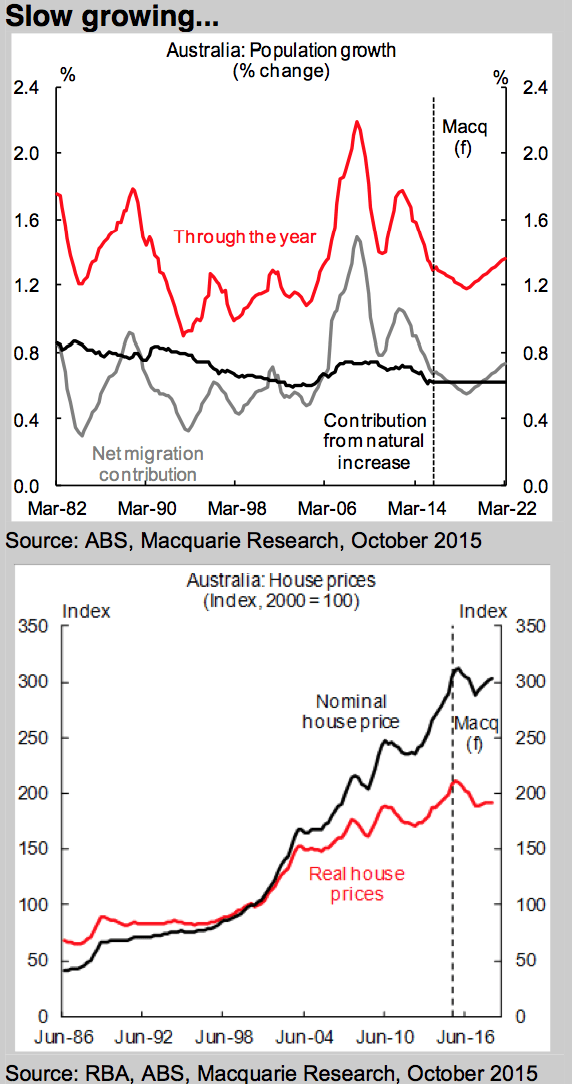

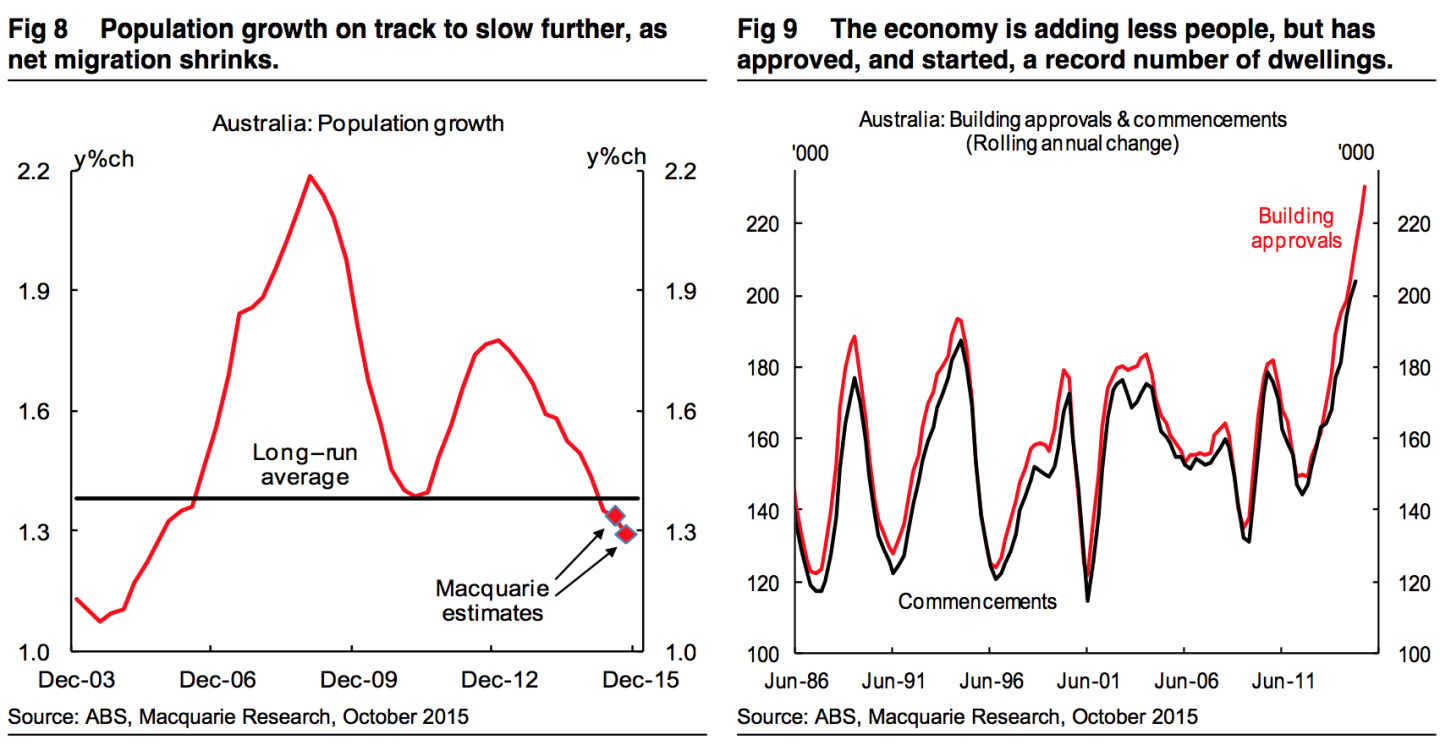

It especially noted Australia’s population growth has slowed and was on track to slow further over the coming quarters.

It concluded while the population growth was still positive, but not as strong as it used to be, that it was not strong enough to justify the major surge in housing supply that will hit the market over the course of 2016.

"Slower population growth adds to the adjustment challenge within the housing market over 2016 as the upswing in supply converges with the impacts of macro prudential policy tools and curbs on foreign investors.

"Building approvals and housing commencements, at 200k+ are running well ahead of estimates underlying demand, which we peg at 170-180k once current, and prospective, population growth rates are incorporated.

"Supply has undershot demand for several years.

"Whilst Australia’s population growth has slowed to a 9-year low, and is on track to moderate further, residential dwelling supply is reaching all new records.

"Building approvals are currently running at an annual pace of 225k, and commencements are following through.

"Both are at new records (figures 8 & 9 below).

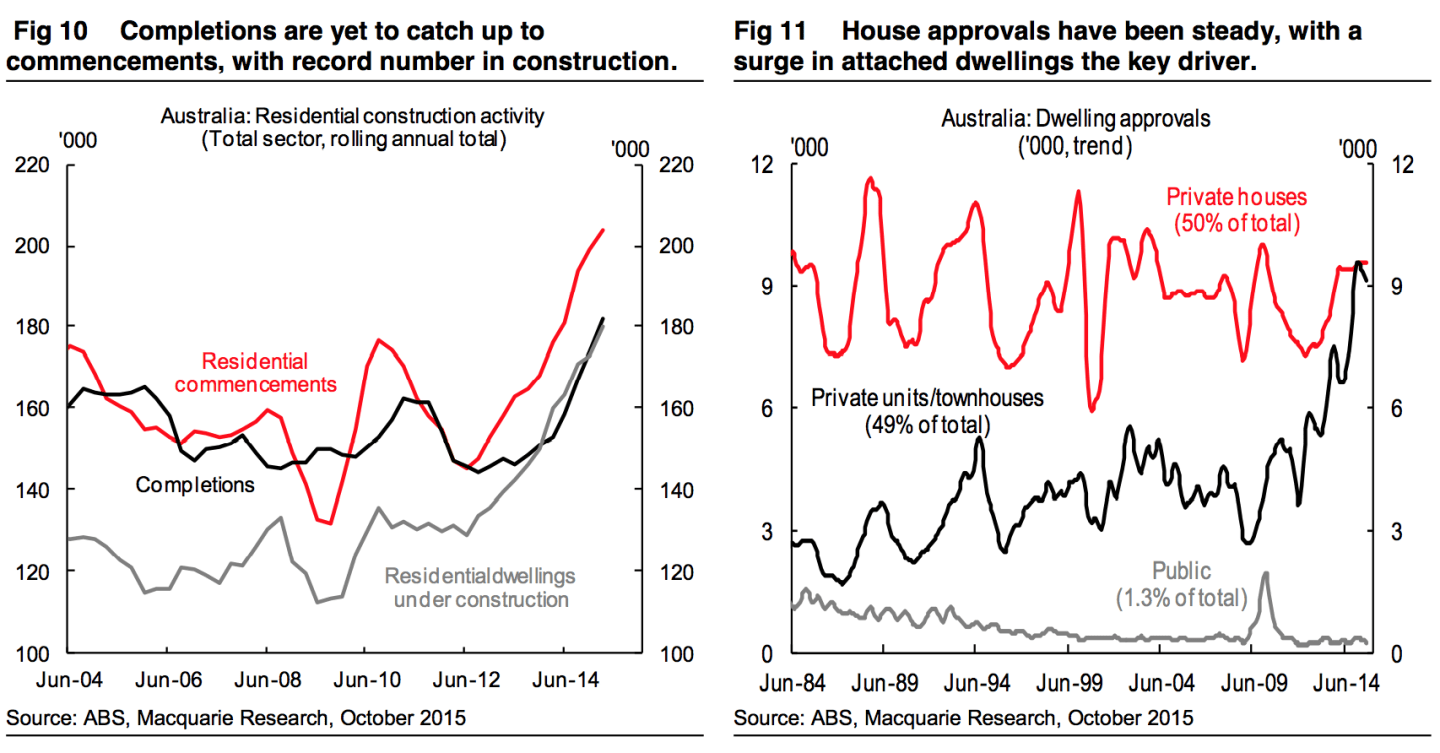

"The full impact on dwelling supply is yet to be felt in the physical market.

"Completions have risen substantially, but they lag commencements, and there is a record 180k dwellings currently under construction (figure 10 above).

"Subsequent pent up demand has been calibrated into prices, through increases in persons, employment, and income per household.

"Unleashing that pent up demand will also have price effects – it will require an improvement in affordability.

"Improving affordability requires either lower house prices, lower interest rates, or stronger household income growth.

"In the absence of robust wage and income growth in the economy, achieving the latter will be more difficult the longer that strong dwelling supply persists."

Macquarie expect a retrenchment in housing commencements through 2016 and into 2017, concentrated in the high density apartment segment.

"This is likely to be accompanied by weaker dwelling prices, as the market struggles to absorb the currently bulging supply pipeline.

"Depending on the speed of adjustment, lower rates may be needed to support demand and prices.

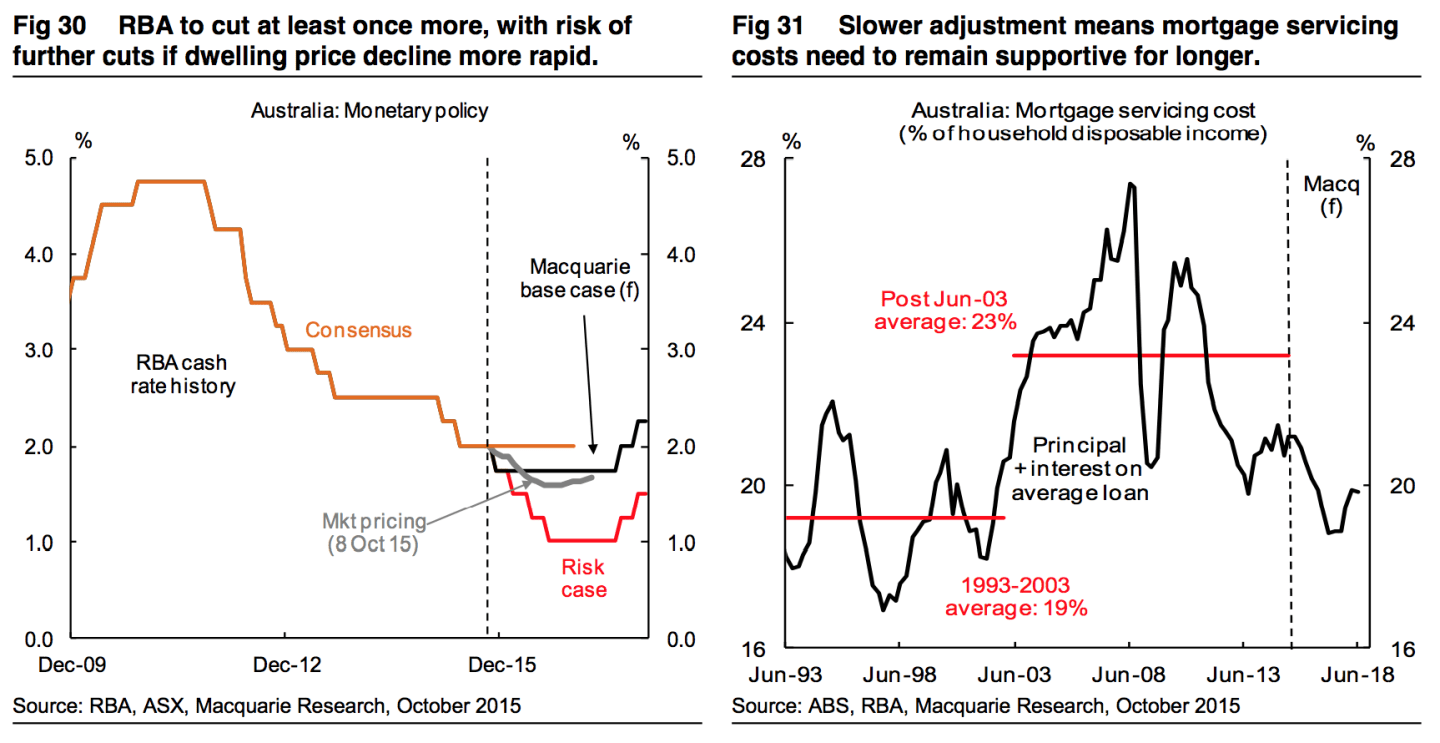

"We remain of the view that further monetary policy easing is likely from the RBA.

"Our base case is that this is delivered in November, alongside downgraded forecasts for growth and inflation.

"We have maintained the view for some time that the risks lie with additional easing in 2016.

"How swiftly the currency falls to a level sufficient to catalyse the transition from mining to non-mining growth is a key driver of the outlook for rates in 2016.

"An earlier, or more rapid, housing construction adjustment – which we expect to accelerate from 2H16 – could mean more cuts will be needed."