Economy in no shape to deal with higher rates: Westpac's Bill Evans

GUEST OBSERVER

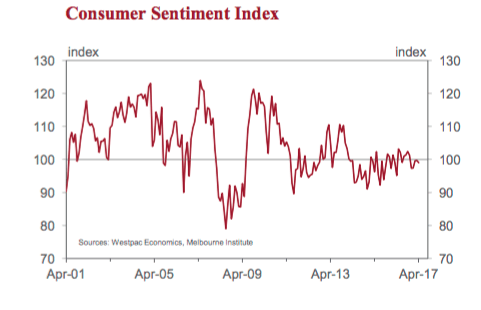

The Westpac Melbourne Institute Index of Consumer Sentiment fell by 0.7 percent in April from 99.7 in March to 99.0 in April.

This is a surprising but welcome result.

Since the last survey there has been intense media attention on housing highlighting concerns around affordability and potential price bubbles. Banks have also increased interest rates for some mortgage borrowers.

Reports on the labour market have been disappointing. The unemployment rate was reported to have lifted back to just below 6 percent.

On the international front, markets have been unnerved by the lack of progress shown by the Trump administration in delivering health care; tax; and infrastructure reform. And recently we have seen a heightening of tensions in the Middle East.

The iron ore price has fallen by 14 percent over the last month while the Australian dollar has pulled back from USD 0.77 to USD 0.75 over the last few weeks.

Arguably these factors could have been expected to produce a marked fall in confidence, particularly around the economic outlook. And indeed the components of the Index relating to the economic outlook have deteriorated.

Individual state issues have also impacted the overall result more than usual. A change of government in Western Australia saw a boost to confidence in the west while higher commodity prices have assisted sentiment in both Queensland and Western Australia.

In addition, speculation around the upcoming Commonwealth Budget has been benign. Accordingly, respondents are more confident about their finances. Contrast this result with April last year when the Index fell by 4% amid nervousness leading into the May Budget.

Any significant negative shocks in the Budget can be expected to render considerable damage to the Confidence Index.

Despite this better than expected result the current level of the Index is hardly encouraging. April marks the fifth consecutive month when the Index has been below 100 – indicating that pessimists are slightly outnumbering optimists.

Confidence around the labour market deteriorated somewhat in April. The Westpac Melbourne Institute Index of Unemployment Expectations increased by 1.8% from 137.9 to 140.3 (higher readings mean more consumers expect unemployment to rise in the year ahead). This Index has been stuck in a narrow range of 136 to 142 over the last year, well above its long run average of

130, highlighting the difficulties the Australian economy has had building any positive momentum in the labour market.

There were diverse movements in the components of the Index. There was some encouraging improvement in those components measuring respondents’ assessments around their own finances. The ‘finances versus a year ago’ sub-index lifted by 8.5 percent while the ‘finances next 12 months’ sub-index improved by 2.4 percent. These results contrast with movements in these components in April last year of -3.9 percent and -6.6 percent respectively. At that time there was much more angst about prospects for the upcoming Budget.

On the other hand, expectations for the economy, possibly reflecting prospects for the housing market and global developments, fell. The ‘economic conditions next 12 months’ and ‘economic conditions next 5 years’ sub-indexes fell by 6.5 percent and 2.7 percent respectively.

Consumer attitudes towards spending also fell, the ‘time to buy a major household item’ sub-index down 2.9 percent.

Not surprisingly, confidence in the housing market deteriorated. The ‘time to buy a dwelling’ index fell by 3.3 percent to 96.3. This read is 6.2 percent below the average over the last 12 months and 20% below the peak levels seen in early 2015. The fall in April reflected large falls in the two major markets – Sydney and Melbourne – partially offset by solid gains in Brisbane and Perth. Clearly affordability factors were behind this divergent response.

The Westpac Melbourne Institute Index of House Price Expectations fell 1.1 percent in April – possibly reflecting additional policies from the regulators aimed at slowing house price appreciation. In that regard it is worth noting that in the year to April 2016, in the aftermath of the previous round of regulatory and interest rate changes the Index fell by 16 percent. Since the Reserve Bank’s rate cuts in May and August 2016 the Index has lifted by 19 percent to be back near previous highs.

The Reserve Bank Board next meets on May 2. The Board is certain to keep rates on hold. As discussed previously the Board is concerned about excessive household leverage which has been boosted by rising house prices. While this concern might be alleviated by a rate hike the real economy is in no shape to deal with higher rates. Considerable spare capacity persists in a stagnant labour market (as indicated by our own index); inflation remains below the Bank’s target zone andis expected to remain at the bottom of the zone; and incomes and confidence are restraining consumption.

The authorities are therefore opting for a policy mix of steady official rates and heightened regulatory controls. As noted with our House Price Expectations Index these regulatory controls, complemented by increases in banks’ rates have been successful in easing conditions in the housing market in the past.

BILL EVANS is chief economist of Westpac.