Rise in first time buyers in NSW despite challenging housing market: Bankwest

A disproportionate rise in house prices compared with wages growth has made the task of first time buyers difficult in NSW, but there was still an increase in their number in the year to August 2017.

A recent Bankwest report reveals a growth in first time buyers (FTBs) of 5.1% (based on ABS data), bringing the total number of FTB purchases to 17,844 for the year.

This is the largest increase since November 2014.

NSW FTBs still face an uphill battle to get their first property with the average couple having to save for six years to get the necessary $148,281 for a 20% deposit on median priced house, according to the 2017 Bankwest First Time Buyers Report.

This time span is an increase of six months from this time last year.

Sydneysiders have to save for 8.2 years (up eight months on last year) to save the necessary $215,133 for a deposit. This makes both NSW and Sydney the country’s most inaccessible state and city for FTBs.

Bankwest general manager personal and small business banking, Donna Dalby said NSW’s FTBs are at the mercy of a number of factors.

“The main reason for this increased savings time at both the state and city level is an increase in house prices compared to increases in wages. House prices went up by 10.7% in NSW whereas wages only rose by 2%.

“All this means the average savings time for a NSW home is 1.4 years more than the national average,” she added.

The challenging nature of the NSW market means home owners are considering other options, such as a looking outside the top end of Sydney’s housing market and into more humble avenues.

This is reflected in the fact that the average house loan size for NSW FTBs was a relatively modest $368,500 in the year to June 2017.

The report also shows that Sydney FTB couples could do well to consider opting for a unit rather than a house as a first home. The average saving time for a unit across Australia is 4.2 years, five months less than the savings time for a house. In Sydney the saving time for a unit is 5.9 years, 2.3 years less than the saving time needed for a house.

“Everyone dreams of having their own house but medium and high density housing is on the increase across the country and can offer a noticeably quicker route to home ownership than aiming at a house purchase,” said Dalby.

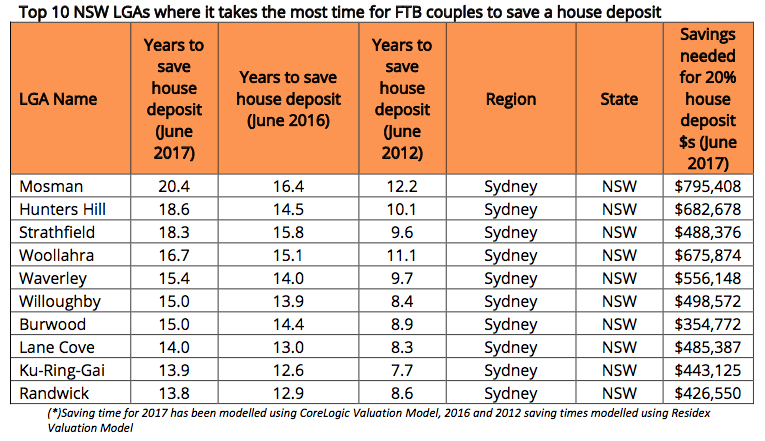

Sydney’s Mosman area was the most inaccessible. FTBs there will require an average of 20.4 years to save a median deposit of $795,408, making the area the second least accessible in the nation behind WA’s Peppermint Grove, said the report.

The significant four-year rise in saving time in the year to June 2017 was driven by a 29.8% increase in Mosman median house prices.

Remarkably however, the nation’s largest year-on-year increase was in Hunters Hill where it takes 4.1 years longer for a couple to save the $682,678 deposit on a median priced house relative to last year.

The findings were part of the ninth annual First Time Buyers Report by Bankwest.

A three-bedroom house at 31 Morish Street, Broken Hill (picture above) recently sold for $115,000.

A two-bedroom house at 27 Central Street, Broken Hill (pictured below) sold in November 2017 for $95,000.