Rate cut more likely than hike in 2017: Secret Agent

GUEST OBSERVER

While many media outlets paint a rather bleak and uncertain future for the world economy, long-term bond yields in Australia finished 2016 higher than at any other point throughout the year.

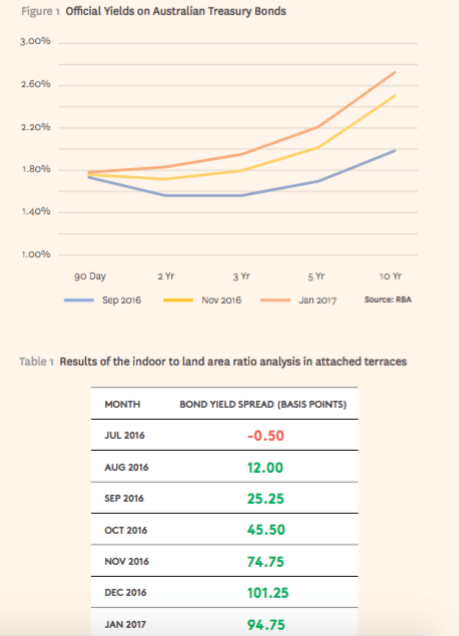

This is even more impressive considering that the cash rate (which has a strong correlation with bond yields) was cut twice for a total of 50 basis points over 2016. Figure 1 shows how much long-term rates increased towards the end of last year and into 2017. Yields on 10-year Australian government bonds have increased by 74 basis points since September and nearly 100 points since the last interest rate cut in August.

Table 1 shows the difference between yields on 10-year government bonds and 90-day treasury bills in basis points (1 point = 0.01 percent).

This tells a similar story to the graph in Figure 1; a widening between short-term and long-term rates. The important point is that this widening from August until December last year is driven by an increase in long-term yields rather than a cut in short-term rates, as it was from July to August.

Often if the yield curve becomes too inverted, the RBA is forced to cut short term rates to improve liquidity by incentivising banks and other institutions to lend out money.

An increase in long-term yields is a dream scenario for the Reserve Bank, as this is a signal of higher investor confidence and a better outlook for the Australian economy.

December was also the first month since September 2014 that the entire yield curve was positive (long term rates above medium, and medium term rates above short term). This is a sign that investors expect improving economic condition in the long run. It also shows investors’ belief that the economy will do well over the next few years.

The ASX Cash Rate Futures market pegs the chances of a decrease in official cash rates at the next meeting (7th March) at 5 percent. While this may seem appropriately low, it does highlight that even with a rising yield curve, investors still believe an interest rate cut is more likely than a hike in 2017.

For more information from Secret Agent, click here.